By: Asal Taheri

Donald Trump’s victory in the U.S. election has revitalized the cryptocurrency market, rekindling investor’s interest; however, will this renewed boom in the market be sustainable during Trump’s second presidential term?

Trump’s victory has a taste of revenge, not only for himself but also for cryptocurrency supporters and the digital assets in which they have invested. On the night of the U.S. elections, following Trump’s success, the price of Bitcoin, the king of cryptocurrencies, rose by 10 percent. As Republicans moved closer to controlling Congress, Bitcoin reached a record high of $106,000 on December 26, reflecting a significant increase since mid-October when it was around $64,023.

It is not only Bitcoin that has been successful in attracting investors. A week after Trump’s victory, in addition to stablecoins designed to prevent price volatility, the top cryptocurrencies grew on average even faster than Bitcoin. The price of Dogecoin, the meme cryptocurrency often promoted by Elon Musk, has more than doubled since election day. The global market value of cryptocurrencies has reached about $3.29 trillion.

This event reflects a remarkable recovery in cryptocurrency prices compared to their sharp decline in 2022 and 2023. These two turbulent years significantly reduced cryptocurrency prices compared to their peak value in 2021, when the crypto craze was at its height. At that time, the Federal Reserve rapidly raised interest rates and curtailed the speculative frenzy that had engulfed the markets following the COVID-19 pandemic. Mismanagement and fraud led to the collapse of several cryptocurrency companies that once seemed reputable (especially FTX, one of the largest cryptocurrency exchanges), calling the entire credibility of the cryptocurrency market into question. Meanwhile, financial regulators, who were skeptical about the profitability of cryptocurrency, opposed digital currencies.

Why Did the Cryptocurrency Market Revive with Trump’s Victory?

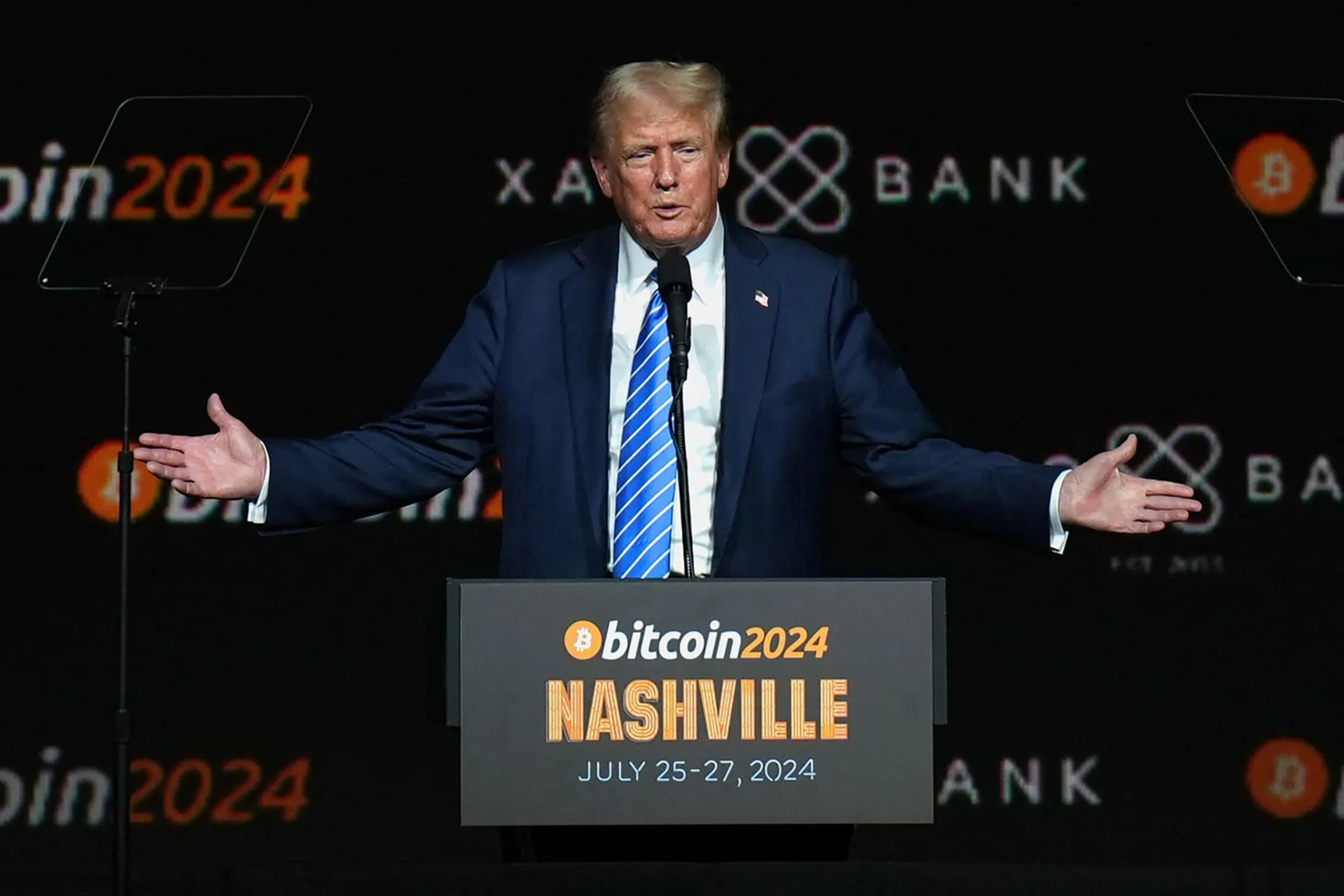

Following the increased attention to the U.S. presidential primary elections in late 2023, an opportunity for change in the cryptocurrency market also rose. A few months later, Trump entered the competition as a passionate supporter of cryptocurrencies and promoted the decentralized financial project “World Liberty Financial,” which his family supports, online. At campaign rallies, he promised to make America the “Bitcoin superpower of the world.” During the election campaign, cryptocurrency lobbyists spent over $100 million to support candidates aligned with this sector in Congress.

Creating this positive atmosphere and sense of calm during the campaign is one of the reasons why cryptocurrency investors are happy about Trump’s return to the White House. Additionally, cryptocurrency lobbyists hope that the change in power will relax the cryptocurrency attendees. Trump promised to oust Gary Gensler, the chairman of the Securities and Exchange Commission (SEC), which was met with enthusiastic cheers from the audience. Regarding this promise, he said: “From now on, the rules will be written by those who love your market, not by those who hate it.” Of course, Trump cannot dismiss Gensler without a specific reason until the end of his term in 2026. Still, it is typical for the Securities and Exchange Commission Chairmen to reign after a new president takes office.

Why Could Gensler’s Departure Improve the Cryptocurrency Market Situation?

Gensler does not believe in the profitability of cryptocurrencies. In October, he expressed doubts for the second time about whether these currencies can be accepted like mainstream currencies, which are filled with scammers and thieves. He has taken a long list of prominent cryptocurrency companies to court, including Kraken and Coinbase (two crypto exchanges), Ripple (a crypto issuer), and Cumberland DRW (a broker-dealer). This has forced many cryptocurrency companies to incur heavy legal costs and invest heavily in compliance; these legal issues and rising costs have impacted the cryptocurrency market’s future and cast a shadow over it.

Amid Gensler’s efforts to combat cryptocurrencies, a controversial claim has emerged that many digital currencies are securities. These fall under the jurisdiction of the Chairman of the Securities and Exchange Commission, and companies that issue, trade, or offer these currencies for sale must be registered with this commission. Securities and sellers must provide more information to regulatory bodies and protect more customers, but digital asset companies do not want to be under such strict oversight; these companies prefer that cryptocurrencies be under a special (and possibly lighter) regulatory system or be regulated as commodities under the less stringent oversight of the Commodity Futures Trading Commission (CFTC).

The Possibility of Softening Regulations

In the potential second term of Trump’s presidency, digital asset regulations may become milder and more consistent. In recent years, the Securities and Exchange Commission and the Commodity Futures Trading Commission have frequently disagreed over which cryptocurrency assets fall under their jurisdiction; for example, in the past, both agencies sought to take responsibility for overseeing Ether, the second most popular cryptocurrency; however, in the end, the Securities and Exchange Commission backed down. Cryptocurrency companies have accused Gensler of constantly changing the SEC’s rules regarding digital assets.

Transparency of regulations may be the most significant achievement for those hoping to turn cryptocurrencies into a popular asset class among investors because, due to the lack of consistent rules in the crypto space, large investors have generally stayed away from this market. Whether or not the regulation in this area will become apparent is still uncertain. Trump may praise cryptocurrencies, but his interest in them will not last long. We should not forget that until 2021, he referred to the creation of Bitcoin as “a scam against the dollar.” Hoping for sustainable compatibility in the cryptocurrency marketer during Trump’s second presidential term may be an emotional and exaggerated approach.

Can Bitcoin Sustain Its Momentum?

In 2025, Bitcoin’s price predictions reflect a range of optimistic or cautious outlooks among analysts. Bullish forecasts suggest that Bitcoin could soar to between $200,000 and $250,000, driven by increased institutional adoption and the introduction of Bitcoin ETFs. Moderate estimates indicate an average price of around $150,000, considering current market trends and investor sentiment. Conversely, bearish scenarios warn that prices could dip to approximately $75,000 or lower due to potential market corrections or stricter regulatory measures.

Key factors influencing Bitcoin’s trajectory include the halving event scheduled for April 2024 and ongoing institutional interest. Notable analysts have made significant predictions: Geoffrey Kendrick from Standard Chartered anticipates Bitcoin reaching $200,000 by late 2025 due to heightened institutional investment; Youwei Yang from Bit Mining expects trading ranges between $180,000 and $190,000 while cautioning about geopolitical risks; and Carol Alexander from Sussex University suggests summer prices could hover around $150,000, with a possible fluctuation of plus or minus $50,000.

Factoids for Crypto

From Skeptics to Advocates

Throughout the years, many influential people and celebrities who didn’t care and were initially skeptical about cryptocurrencies have become its advocates.

Elon Musk, Ceo of Tesla and SpaceX, was quite cautious about cryptocurrencies, questioning their energy consumption and scalability. Over time, Musk became an outspoken supporter, particularly of Bitcoin and Dogecoin. Tesla even bought $1.5 billion in Bitcoin and briefly accepted it as payment, though he later raised concerns about Bitcoin’s environmental impact.

Mark Cuban, Entrepreneur and owner of Dallas Mavericks, once stated he preferred investing in bananas over Bitcoin, calling crypto a “collectible” with no intrinsic value. Cuban later embraced cryptocurrencies, particularly Ethereum and smart contracts, citing their potential for innovation. The Dallas Mavericks now accept crypto payments for tickets and merchandise.

Investor and Shark Tank star, Kevin O’Leary, called Bitcoin “garbage” and dismissed cryptocurrencies as speculative. Nowadays, however, O’Leary has invested heavily in Bitcoin and other cryptos. He emphasizes their potential as an asset class and sustainable energy innovation.

Jim Cramer, known for being the host of CNBC’s Mad Money, called Bitcoin a speculative and risky asset. He later invested in Bitcoin and Ethereum, describing them as a hedge against inflation and a store of value.