By: Farid Atighehchi

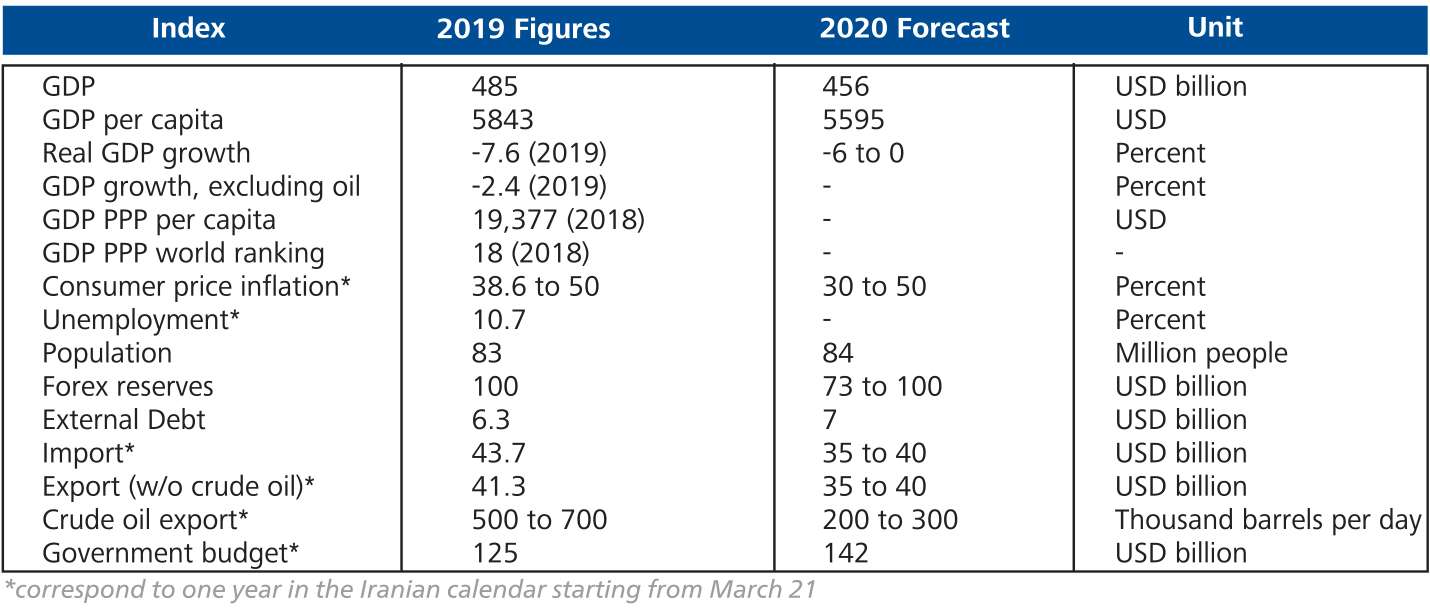

Just when everyone thought the Iranian economy has seen it all and that things couldn’t possibly get any worse after the US implemented the so-called “harshest sanctions in history,” the corona virus pandemic hit the country and the price of oil started to plummet into historic lows. While it is too early to fully understand and predict the overall impact of these developments on the Islamic Republic, the region and the rest of the world, two things are clear; first, 2020 will possibly be one of the bleakest years in recent memory for the world and certainly for Iran; and second, the Iranian economy, while badly bruised, will once again be able to absorb the shock, even if at high costs of higher unemployment, inflation, Forex rates, lower productivity, lower production levels across industries with a few exceptions, foreign investment and spending in development projects.

In a series of articles by multiple authors starting with this one, Trends will be covering major economic developments in Iran from the past year to the present, analyzing the impact of the corona virus pandemic and low energy prices, while trying to predict what lies ahead for Iran’s economy and business community in 2020 and early 2021.

Two major economic developments have happened since the beginning of 2020. One is the pandemic which is troubling some economies and sectors more than others. The other is the sharp drop in oil prices which, despite the end of the short lived price war between Saudi Arabia and Russia, still kept declining further away from its 67 USD Brent value at the start of 2020 to historical lows of under 10 USD. Since Iran has been under US sanctions, its oil sales have dropped to unverified amounts. High estimates are 500 thousand barrels per day. Assuming Iran keeps up with that number, the drop in oil prices to an average 33 USD per barrel forecast by the US Energy Information Administration, translates to 34% lower revenues than the government planned for, or around 3 billion USD short of expectations. That is a tough situation for the Iranian oil industry, but for an entire economy which went from 2 million barrels of exports a day in 2017 to 500 thousand, the changes in oil prices are simply another inconvenience. The situation with the pandemic is a little different. The human calamity is not quantifiable in its entirety simply in monetary terms that could account for the investments in education lost, the absence of services that could have been provided by the victims and the healthy lives they could have led. However, one of the measures we have to try to understand this crisis is the years of life lost, or YLL, which is used in the field of public health. Analysts at Ara Enterprise find this number to be more than 55,000 by mid May. This means that around seven thousand reported deaths due to COVID-19 in Iran by this time, amount to over 55,000 potential years of life lost. What is easier to evaluate is on the macro level where again the effects in Iran are relatively lower than most countries because only a small share of the economic output actually comes from production. Although trade was also hit and the non-oil exports did drop by 30% in March, by anecdotal accounts of customs officials, trade and intermediary activities are rather impervious to the outbreak. For Iran, the problem the pandemic poses is less about the economic value and more about the social issues it exacerbates.

Official estimates project the economic output in the current year will decrease by anywhere between 7.4% to 11%. These are mostly felt in wholesale, retail, cargo and passenger transportation, rubber and plastic production and food and beverage services. Iranian businesses have been quick to adapt via provisional processes and arrangements that may well linger afterwards. However, even many online businesses are feeling the pressure as we see in the interviews of this issue of Trends. What truly cuts deep will be the forecast of the 2.9 to 6.4 million who are currently employed and will lose their jobs, sending a raft of people into distress. The government has to keep the economy afloat for another year before the implications of today’s policies and issues are better understood.

Official estimates project the economic output in the current year will decrease by anywhere between 7.4% to 11%. These are mostly felt in wholesale, retail, cargo and passenger transportation, rubber and plastic production and food and beverage services. Iranian businesses have been quick to adapt via provisional processes and arrangements that may well linger afterwards. However, even many online businesses are feeling the pressure as we see in the interviews of this issue of Trends. What truly cuts deep will be the forecast of the 2.9 to 6.4 million who are currently employed and will lose their jobs, sending a raft of people into distress. The government has to keep the economy afloat for another year before the implications of today’s policies and issues are better understood.

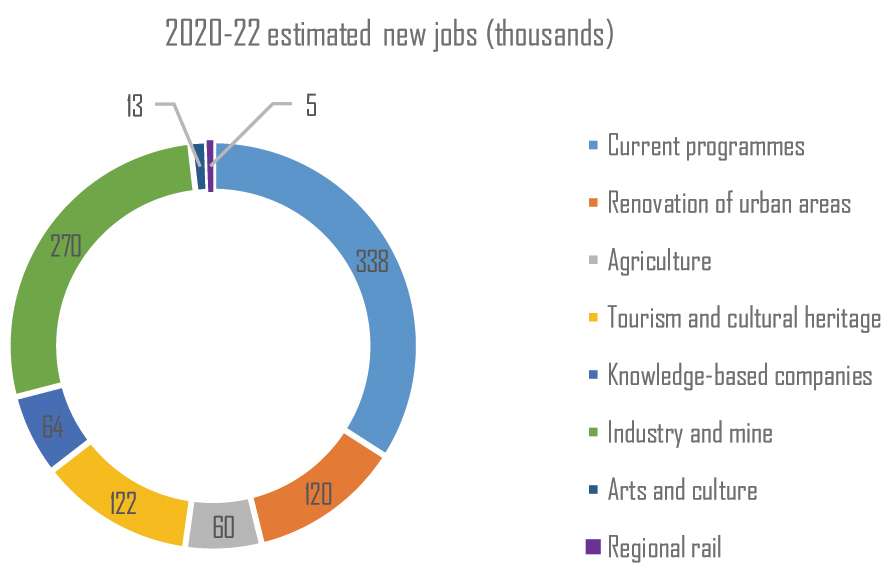

Iran is a market of eighty-four million people, a pioneer among Middle Eastern oil exporting countries in diversifying against its oil revenues and a progressive among the Muslim countries, characterized by high internet and mobile phone penetration, relatively advanced healthcare and an educated and young population. However, the US reneged on its deal with Iran and other world powers, and stood in the way of Iran’s growing integration into the world economy. The year 2020 marks the second year after the US withdrew from the nuclear deal. Once ready to celebrate its jump start, the government officials instead have been, for the past months, allaying domestic fears of an economic nosedive. The early panic and frustration after the return of the sanctions is giving way to a sober anticipation of recession and continuous belligerence from the US. Nevertheless, with a strong focus on job creation, economic development in urban and rural areas and negotiating the diverse interests in its vast economy, Iran seems committed to avert having the same fate of countries such as Venezuela which is experiencing hyperinflation. Still, given the recent economic setbacks, the government cannot help but abandon its earlier ambitions such as its plan to lower unemployment rate to 7%. This year the unemployment rate would have been persistent if it was not for the impact from the pandemic, which will force the lay-off of 2.9 to 6.4 million employees. The lay-offs are distributed across most sectors of the economy but people in wholesale and retail, cargo and passenger transportation, textile and clothing manufacturing, food and beverage services and sales and after-sales of vehicles are projected to bear the brunt of the cutbacks. Among consumers, purchasing power is still ailing but an inflow of cash from the Central Bank, in an expansionary mood, will marginally support consumption levels. Mass market shifts to lower price ranges and substitute products compete for a place in the consumer basket. The risk of hyperinflation is minimal as the government, the Central Bank and policy makers promise to rein in the growing money supply.

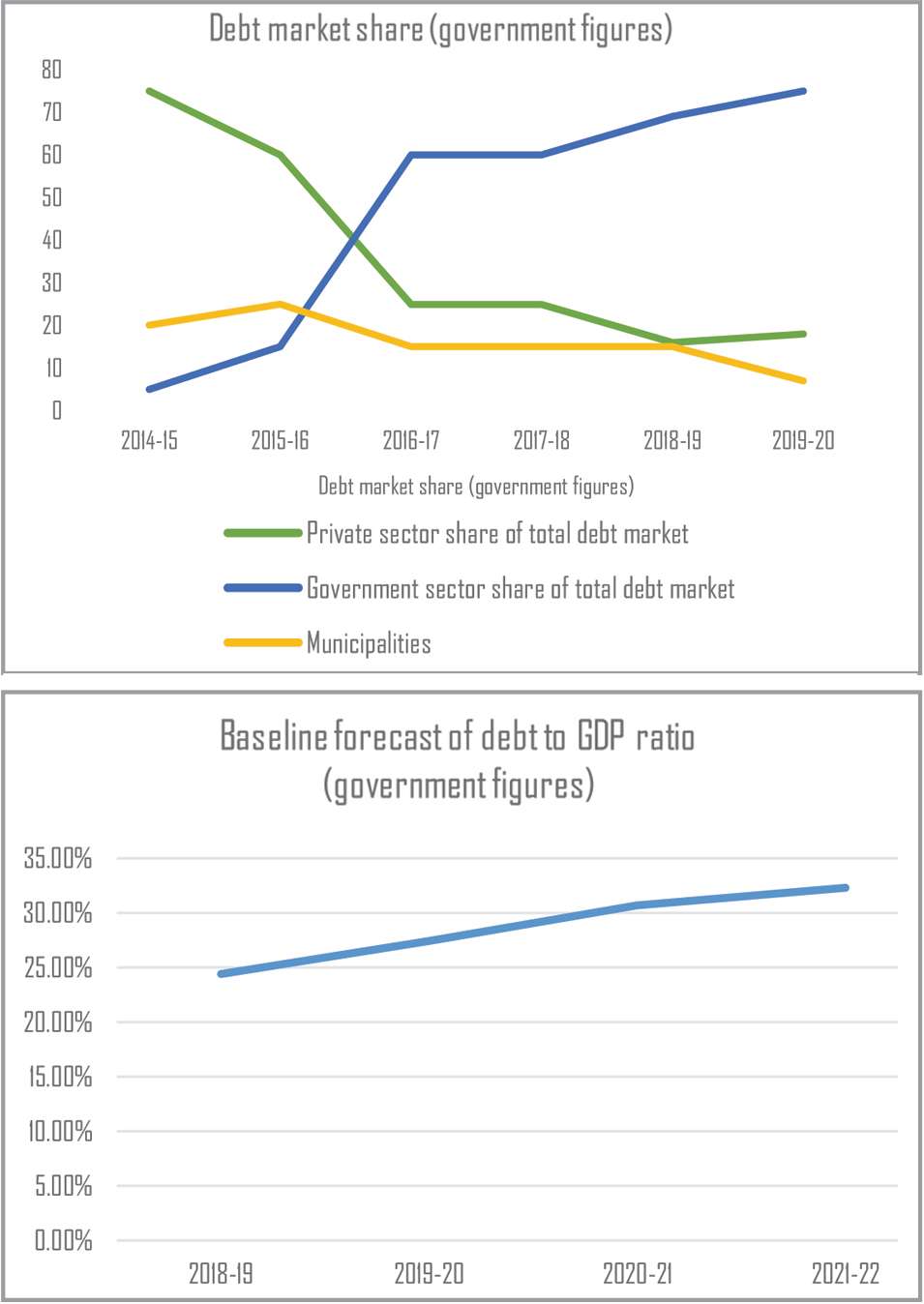

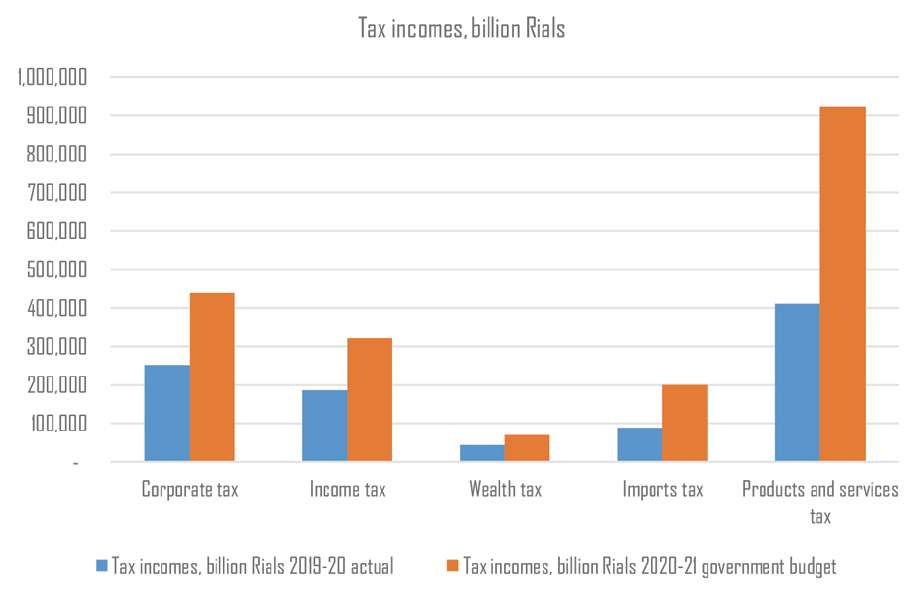

The current administration set its heart on strengthening the private sector from the outset. Notwithstanding, and as a matter of pragmatism, it capitalizes on public debt rather than public-private partnerships. The government is fully supporting the Tehran Stock Exchange, is developing new financial instruments and is expanding the financial and debt markets. Meanwhile, production is impacted by high price inflations. Iran has lowered its expectations of revenues from exports of oil and gas by 68% – still assuming sales of a million barrels of oil per day – and is shifting its focus of income to taxes and the debt market. Government investments in fixed assets continue to rise. And critical risks in the economy will be avoided as the Central Bank chief promises restraint in using foreign exchange reserves.

Consumers and the Consumer Market

Employment

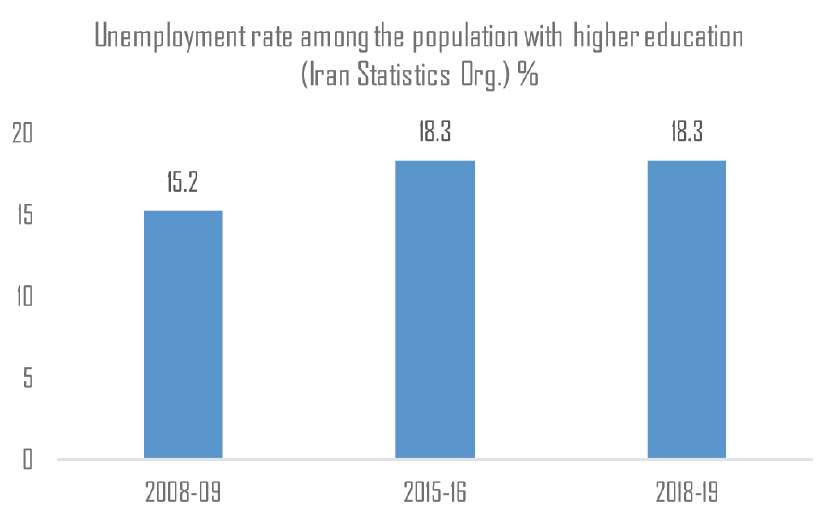

The high unemployment rate, especially among the youth and the population with higher education has been a sore point for decades. The government plans to create close to a million new jobs in 2020 by ramping up several programs to stimulate economic activity and directing its relevant platforms towards this agenda. For example, the government is changing its criteria for rewarding projects in the knowl edge-based economic program, prioritizing job creation. The start-up scene in Iran has especially been a magnet for fresh capital. On the other hand, the government is facilitating credits to commercial banks for their customer loans and projects they put forward. For such projects the credit facilities have been on average 4,000 USD per each new job created. All this is for good reason as with every single person losing their job, an average family of 3.4 persons may plunge into poverty.

edge-based economic program, prioritizing job creation. The start-up scene in Iran has especially been a magnet for fresh capital. On the other hand, the government is facilitating credits to commercial banks for their customer loans and projects they put forward. For such projects the credit facilities have been on average 4,000 USD per each new job created. All this is for good reason as with every single person losing their job, an average family of 3.4 persons may plunge into poverty.

There are also plans to export labor. This is a rather underdeveloped initiative with a 6% success rate in 2018. The aim is two-fold: first, employment producing foreign currency remittances, second, changing international labor trade balance – enacting a new policy which extricates job positions occupied by non-nationals and gives the positions back to nationals. The official unemployment rate stood at about 11% by early 2020 and the push by the government will slightly alleviate the situation. For the government, one hurdle in this front is that matching a person to a job is somewhat out of its control. As a result and while economic activity decreased, fewer have been participating in the labour market. This may change in 2020, but not enough to conspicuously affect the unemployment rate.

On the demand side of the labor, the shortage of jobs for the population below 35 years old is especially visible. Most of the new jobs are low-quality work which do not require high skilled and may help towards reversing the trend of a higher unemployment rate among the youth in comparison with the older generation.

Many of the new jobs are part of government-subsidized projects but a lot of them never actually launch. This reduces the number of genuine new jobs with pay and curbs any breakthrough in the employment agenda in 2020.

The government admits that this is an “increase in employment without an increase in production activity,” as labor efficiency has decreased by 3.3% in one year. Full-time jobs are shrinking and part-time jobs are growing. Most of these new vocational positions happen to be in small operations where they do not reap cost advantages of scale.

The government admits that this is an “increase in employment without an increase in production activity,” as labor efficiency has decreased by 3.3% in one year. Full-time jobs are shrinking and part-time jobs are growing. Most of these new vocational positions happen to be in small operations where they do not reap cost advantages of scale.

Officials fear for the people who may experience job insecurity, low wages and a lack of insurance coverage. With this insight into a persistent unemployment trend, the government will try to lower household income risk. For example, some of the other programs starting in 2016 have shown progress in rural areas, with provincial employment growth rates being higher than those of urban areas. This trend seems to correlate with increasing urbanization, reversing migration flows back to rural areas. The trend will continue this year.

Wages, Consumption and Inflation Iran has seen many periods of high inflation during the past five decades. It is usually the minimum wage growth that is sacrificed in the name of controlling inflation and this threatens consumption. Even the official wage growth of 15% is way below inflation. In the past few decades, wages rarely got on par with the inflation rates. Now, the calculation of consumer basket inflation seems to have become skewed and reflects realities on the ground less accurately. The year 2020 will be no different. The government raised its own employees’ salaries by 15%. Labour unions negotiated with the Supreme Council of Labour a raise of 21% for the minimum wage. While proponents of that raise increase argue that there have been increases of more than 21% in some benefits, the gap between inflation and income is very much felt in retail as the purchasing power of low- and middle-income classes declines. Still, the government will try to improve the livelihood of workers. For example, it is entertaining the idea of using part of the gains from the recent fuel price increase to insure undocumented employees in rural areas. Furthermore, in 2020, it will hand out 5 billion USD in cash to 78 million Iranians.

If you are interested in gaining the latest news about Iran’s Economic Out look , you can follow this path.

This may provide a feeble sense of stability and a semblance of normality which could boost consumption. Spending was mostly lowered in 2019 in the shock of major economic misfortunes, including a critical bout of currency devaluation, starting in mid 2018. The Supreme Council of Labor estimates that the cash hand-outs will cover about 3% of the household basket.

The slow growth in wages changes the consumer market landscape. The mass market will see a shift in market shares as cheaper goods will take over brands which previously dominated the low and premium price ranges. Competition between substitute products will be fierce, largely surpassing competition between brand names. Manufacturers who cannot adapt to new price ranges by sacrificing quality, as is somewhat traditional, will lose their scale advantages. Failure to adapt will pave the way for new entries. However, the merger and acquisition activity will remain very limited and mostly in-house among niche or large operators. One of the few reasons is that a government working against unemployment frowns upon anything which may counteract its efforts.

A recent program limits the sale of businesses in financial distress. In 2018 alone, about 34,000 jobs were saved through this restriction. This was done by bailing out 5,600 companies that were loss-making or outright bankrupt, some of which were found by officials to have no marketable products at all. Business loans, even if thinly stretched over a large population, and the cash hand-outs subsidizing people out of poverty will raise the money in circulation between them. Nonetheless, the Central Bank is demonstrating strenuous efforts to escape the risk of hyperinflation. The Bank’s policies are more than coordinated with the state, including with bodies such as the Expediency Council. Hyperinflation is an inherent risk to the expansionary monetary policies, especially in the face of the current budget deficit and the lower economic activity. Because of this, the Council stresses that it is preparing by setting up mechanisms for the eventuality of contractionary monetary policies.

Investment and Manufacturing

Monetary Policies

As the government prioritizes employment and consumption, it will persuade the Central Bank of Iran, CBI, to facilitate investment to those ends. As Iran entered into recession in 2019, CBI lowered the rate of interest charged on short-term loans among banks to below the rate of inflation to stimulate debt market exchanges. This year, CBI lowered the rates from around 20% down to 18.5%. It appears likely that CBI would keep the short-term rates below inflation rates for a more extended period, during 2020 and probably beyond. However as the banking system’s role in the current crises becomes stronger, banks find it easier to negotiate regulatory leeways. Government bonds and sokuk, an Islamic form of bonds, in the debt market are currently exchanged at 21% and interest rates fluctuated from 15 to 30% between early 2018 and early 2020.

The government has been relying on issuing bonds for its financial needs more and more. This results in the financing of 17% of all government revenues through sokuk. That is about 4 billion USD worth of sokuk for all expenditure and another 3 billion USD exclusively for expenses in upstream OGP. Altogether this value is twice that of 2019. Historically, the government has raised interest rates on bonds to attract capital. However, this trend inadvertently renders the debt un-competitive for the private sector. In January, CBI started its first ever Open Market Operation, or OMO, an operation that gives and takes liquidity from banks to increase or reduce the supply of money. Critics argue that OMOs should be operated in a floating foreign exchange rate model, not a fixed one like the one in Iran. Others find it counter intuitive to conduct the transaction through Tehran Stock Exchange, as CBI does. However, in an interview with Resalat, a former high-ranking bank executive, Hatami Yazdi, identifies OMOs’ intended role, not as a mechanism to control interest rates, but as a means to “cover banks’ deficits and save them from bankruptcy.” It is unlikely that CBI puts much effort in curbing interest rates. The uncontrolled interest rates may lead the total debt stock to reach an equivalent of 30% of the GDP in 2020.

The lowered short-term rates along with the introduction of OMOs may signal efforts to lower the cost of capital, especially through lowering the risk of default on public debt. Although the rising levels of debt may make controlling the fluctuations of interest rates difficult, the government is resolved to prove otherwise. In 2020, the risk of default might be lowered and the government will facilitate further private and semi-private investment. The question is if it can realize these new prospects, especially through public-private partnerships. Despite the government’s intentions, not all the money from CBI, which is supposed to stimulate investment, will end in real production.

As exports are expected to fall, the Rial will be devalued, interest rates on loans will be lower than the expected devaluation of the Rial and there will be a consequent inflation of land prices. Realizing this, debtors take out credits to buy existing land on the promise of new ventures, buildings or plants. The act of buying existing land adds nothing to the real gross domestic product while constructing buildings and plants does.

At the same time, CBI cannot afford to raise interest rates in the short-term because it is trying to control the growth of the money base. Overall, 2020 ushers a period of high leverage activity. While the mergers and acquisitions, or M&A, market is very small, capital will find its way to investments in purchasing lands disproportionate to production requirements of the projects. For businesses where export is still operational despite sanctions, a growth in M&A activity is expected. The real estate market will be buoyed as demand to exchange existing land is rising and this increased activity does not mean there will be a change in the mix of homeowners and tenants, but will raise the price and rent of small apartments.

The government is aware of this effect and is rather actively trying to take advantage of it. The buzz phrase is “leveraging (budget’s) construction credit,” by which the government wishes to engage private capital in public-private partnerships by leveraging its low cost of capital. Eventually this will translate to riskier businesses with high debt ratio, as the government’s actual success in engaging private capital has been debatable. State and the parastatal are still the dominant part of the economy. Their continued growth despite their sheer size relative to the whole economy is unmistakable. At about 142 billion USD, the government budget in 2020 alone is equivalent to more than a third of GDP forecasts. Parliament argues for most of the credit to go to the state and the parastatal, which fosters higher credit risks for projects.

Public-Private Partnership

As yet another indicator, non-current credits in the banking system have a high ratio at 10%, well above the desired 5%, in proportion to all credits. CBI tries to redirect credits, mostly toward mining operations in hopes of quicker foreign exchange returns from exports. The government will encourage public-private partnerships by locking resources at a provincial level. All projects defined at the provincial level can access 10% of the allocated resources for the province. To dip in beyond that 10%, new initiatives must be defined through public-private partnerships. Nonetheless, neither the previous performance in engaging the genuine private sector has been stellar nor can the current plans ensure their fate in the hands of the commercial banks.

The government will especially try to refocus its and others’ investments to oil and gas upstream – in fields jointly owned by other countries – on mining and industrial production in underdeveloped regions and on sugar beet processing.

Tehran Stock Exchange

Tehran Stock Exchange has flourished in early 2020 as an important state platform to attract parastatal, institutional capital and retail investors. As the government puts it in its analysis of the budget, “the majority of financial activities in the stock market belongs to the state.” The government is keen to keep the Exchange not only lively but maybe bullish.

During the week after the assassination of Major General Suleimani, TSE was in shock. The government intervened by the spread from the usual 5% to 2% and by allowing companies to raise their price per equity through revaluing their assets. CBI also intervened by offering loans through commercial banks for purchasing public shares. We could expect the Exchange’s growth in 2020 to come not from initial public offerings, or IPOs, but from the effects of such interventions, though more IPOs are expected of state companies. In 2020, this takes the shape of exchange traded funds, or ETFs, affiliated with the government and state. Overall, the Stock Exchange promises more immediate success in attracting capital than public-private partnerships.

Manufacturing and Services

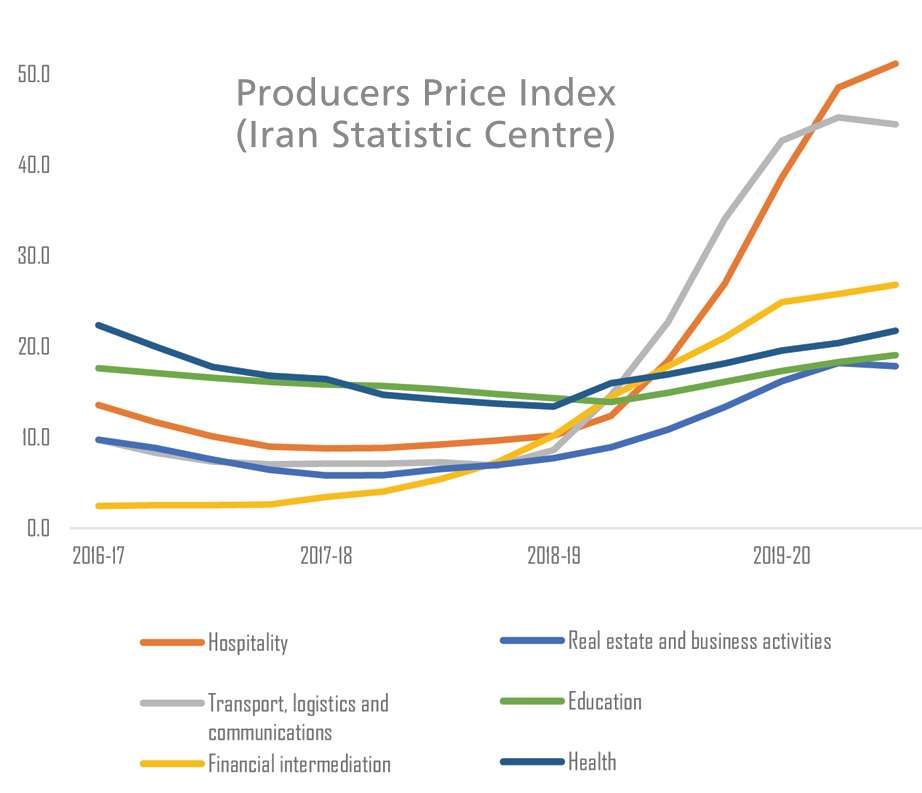

Although lower demand because of the pandemic is balancing out the producer price index, or PPI,in the first quarter, the rising costs of imports and lower domestic supply will raise the PPI in 2020.

As, regardless of the sanctions, exports of raw material prove easier than finished goods, the downstream will be more affected by the rise in the PPI. In October 2019, the Ministry of Industry, Mine and Trade raised export tariffs on raw materials to an average of 25%. However, by early 2020, it faced strenuous opposition from upstream producers and cut the tariffs in half. The government does not have enough mechanisms and clout over the mostly parastatal producers to effectively control price inflations, and it appears to withdraw from this in 2020, leaving PPI’s fate to the market. PPI will then rise or, as demand lowers by a contracting economy, stay at the current levels. The government tries to compensate by providing incentives for production and foreign investment. However, efforts such as extending the visa of foreign investors have no real impact on investment returns. Investment in the downstream of many value chains will especially suffer as it takes time to adjust to the new situation, and producers are not equipped to compete in other markets, that is, if they bypass the sanctions and export their goods.

Other efforts, such as reining in a rogue banking system, have been instrumental in directing the flow of capital to real production.

Starting from as far back as 2016 the government has been assuming the debts of banks to CBI in exchange for its own debts to outside creditors. This year, CBI will try to merge loss-making or poorly managed banks, therefore credit risks of banks should decrease, making them more eligible partners for both CBI and the market.

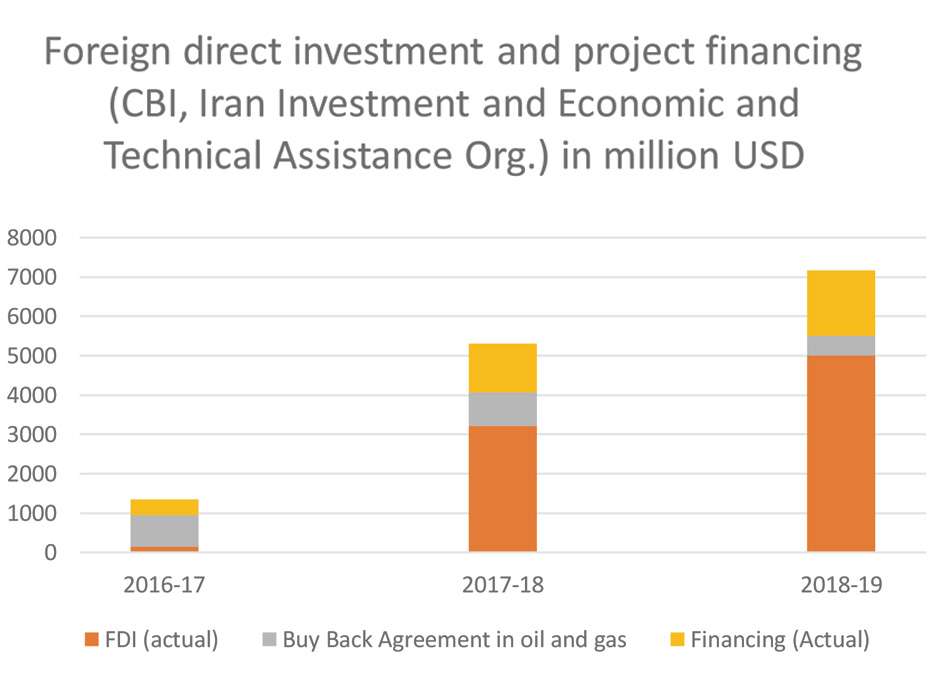

Government Spending

The government plans to spend 26 billion USD in the 2020-21 fiscal year. It also plans to attract 15 billion USD in foreign direct investment and another 20 billion USD in foreign investment in public-private partnerships but this might prove to be too ambitious. For one, it has not historically been able to do so and this year, with the sanctions back in place, and the pandemic, it seems to be an impossible job. In 2017, before the US left the Joint Comprehensive Plan of Action, JCPOA, Iran made agreements worth 32 billion USD. However, afraid of primary and secondary sanctions and a growing credit risk, only a small fraction has been realized, mostly from Chinese investors and the Islamic Development Bank. There is also almost no cross-border M&A activity. At the same time there are no improvements in sight in investment infrastructure neither. The Iranian economy suffers from an underdevelopment of mechanisms and instruments necessary to facilitate foreign investment.

The government plans to spend 26 billion USD in the 2020-21 fiscal year. It also plans to attract 15 billion USD in foreign direct investment and another 20 billion USD in foreign investment in public-private partnerships but this might prove to be too ambitious. For one, it has not historically been able to do so and this year, with the sanctions back in place, and the pandemic, it seems to be an impossible job. In 2017, before the US left the Joint Comprehensive Plan of Action, JCPOA, Iran made agreements worth 32 billion USD. However, afraid of primary and secondary sanctions and a growing credit risk, only a small fraction has been realized, mostly from Chinese investors and the Islamic Development Bank. There is also almost no cross-border M&A activity. At the same time there are no improvements in sight in investment infrastructure neither. The Iranian economy suffers from an underdevelopment of mechanisms and instruments necessary to facilitate foreign investment.

This year, Iran hopes to realize previous agreements with China for infrastructure, oil, gas and petrochemical sectors’ development. The rest, including actual new investments, will be random and perhaps rare occurrences. The government itself is not to lower its expenditures. About 114 billion USD, 74% of its budget or an equivalent of 24% of the GDP, will be spent on government-affiliated companies, a 16% increase compared to last year and above the 14% growth of the total budget expenditure.

There is news from the US Treasury that Iran has access to only about 10% of its 90 to 100 billion USD foreign exchange reserves. While the limited access appears highly plausible, there has been no official acknowledgement of the situation from Iranian officials except for the CBI Chief asserting that he will not dip into the reserves to handle the current situation. This further signals that critical risks in the economy will be avoided this year. In 2019 and after the US departure from the JCPOA, Iran still managed to reach 73% of its crude oil volume sale, and the difference was balanced out by a 25% higher than anticipated price increase at the time. Emboldened by extrapolation of rising crude oil prices and despite a forecast of more than 7.6 billion USD deficit for 2020, the government intended to keep its expenditures high. However, the anticipated oil revenues were not realized and taxes and debt were considered to fill that void.

However the pandemic hit and those high expectations in neither oil nor tax revenues are any longer within reach. Recently it was enacted to tax economic activities under the military and paramilitary, along with two of the top parastatal powerhouses, the Execution of Imam Khomeini’s Order and the Astan Quds Razavi. Despite their gargantuan income, the tax revenues from these organizations are not reflected in the yearly budget. The easy taxation targets seem to be downstream production, sales and retail. The government expects a 31.2% increase in tax income on products and services. That does not bode well for producers and businesses that are closer to end users who now see difficult times ahead. In terms of current prices, government investment in fixed assets will increase, but these investments mostly end up in buying land rather than adding to production. This is evident in the government’s official measure of efficiency of yearly -1.1% between 2012 to 2018. In the same period it is also symptomatic that the number of public construction projects have doubled but their completion has taken longer, increasing from 11 to 16 years. This trend is expected to continue in 2020. However, this year, a good part of loans from commercial banks are advertised to be directed to non-oil exports. As incentives with low interest rates, they could cover the working capital of export-oriented businesses in order to improve the chances of the funds ending up in real production. The relevant funding was secured in early February, but the pandemic may heavily impact this plan in details or its entirety, while real growth in production has to tackle high producer inflation and a tighter grip by taxes.

Exports

Oil and Gas Exports

In early 2020, Iran projected to sell one million barrels of oil per day, which seems unlikely given the expiration of US sanctions’ waivers and the forecasts putting possible sales at no more than 200,000 to 300,000 barrels of oil per day. To offset the drop in oil exports, at least partially, the government intends to offer crude oil in its specialized commodity exchange in hopes of attracting private buyers who may then consume or resell. The first such transaction was concluded in November 2018, with the offering of 300,000 barrels. Before this date, the Kish Island Commodity Exchange had only dealt in oil products. However, buyers did not show up and it seems counter intuitive to expect a transparent exchange market to bypass the sanctions.

There is also the matter of oil prices. The Iranian government calculates its finances for 2020 at 40 to 50 USD per barrel. However the outbreak of corona virus disrupted an already decelerating Chinese demand and that of other markets and pulled Brent prices down to under 10 USD per barrel. Even the hopeful post-pandemic global outlook does not promise to resurrect oil prices.

The US Energy Information Administration estimates Brent crude oil price to be 33 USD per barrel in 2020. In Iran, the plan is to continue and develop oil-for-goods exchange plans with oil and gas importers, but that future is complicated with sanctions on oil exports and banking activity. Iraq, for example, continues to receive waivers to import gas and electricity from Iran, as otherwise the disruption in energy supply to the country might jeopardize the Iraq’s security and social order, something neither Iran nor the US would want. However, with most of its budget locked in a US controlled account, Iraq cannot afford to face sanctions. Even with the waivers, the payments do not make it through to Iran as the value of gas exports from Iran to Iraq are disproportionately higher than imports by Iran.