By: Asal Taheri

The fine wine and art markets, once bastions of luxury and investment, have experienced a stunning decline in 2024, leaving collectors and investors grappling with the fallout. Just a year prior, these markets thrived, buoyed by record-breaking sales and soaring valuations; however, the landscape has shifted dramatically. In 2023, global auction sales for fine art reached $65 billion, while the fine wine sector enjoyed a robust appreciation of values. Fast forward to 2024, and the All Art index reports an alarming average decline of 16%, with fine wine prices similarly plummeting by approximately 11%. This downturn is not merely a statistical anomaly but a reflection of deeper economic currents, shifting consumer preferences, and market corrections that have left many questioning the future of their prized investments. As the dust settles on this tumultuous year, the question looms: can these markets recover their former glory, or are they forever altered in the wake of unprecedented challenges?

Economic Pressures

Rising Interest Rates

One of the most critical factors impacting the fine wine and art markets is the increase in interest rates. In 2024, central banks raised interest rates to combat inflation, leading to higher borrowing costs. This environment has made financing luxury purchases more expensive, causing investors to reconsider their allocations to non-income-generating assets like fine wine and art. According to the Liv-ex Fine Wine 1000 index, prices have fallen approximately 11% year-on-year due to these economic shifts. Potential buyers may delay purchases or seek lower-priced alternatives as borrowing costs rise, further straining market demand.

Inflation and Economic Uncertainty

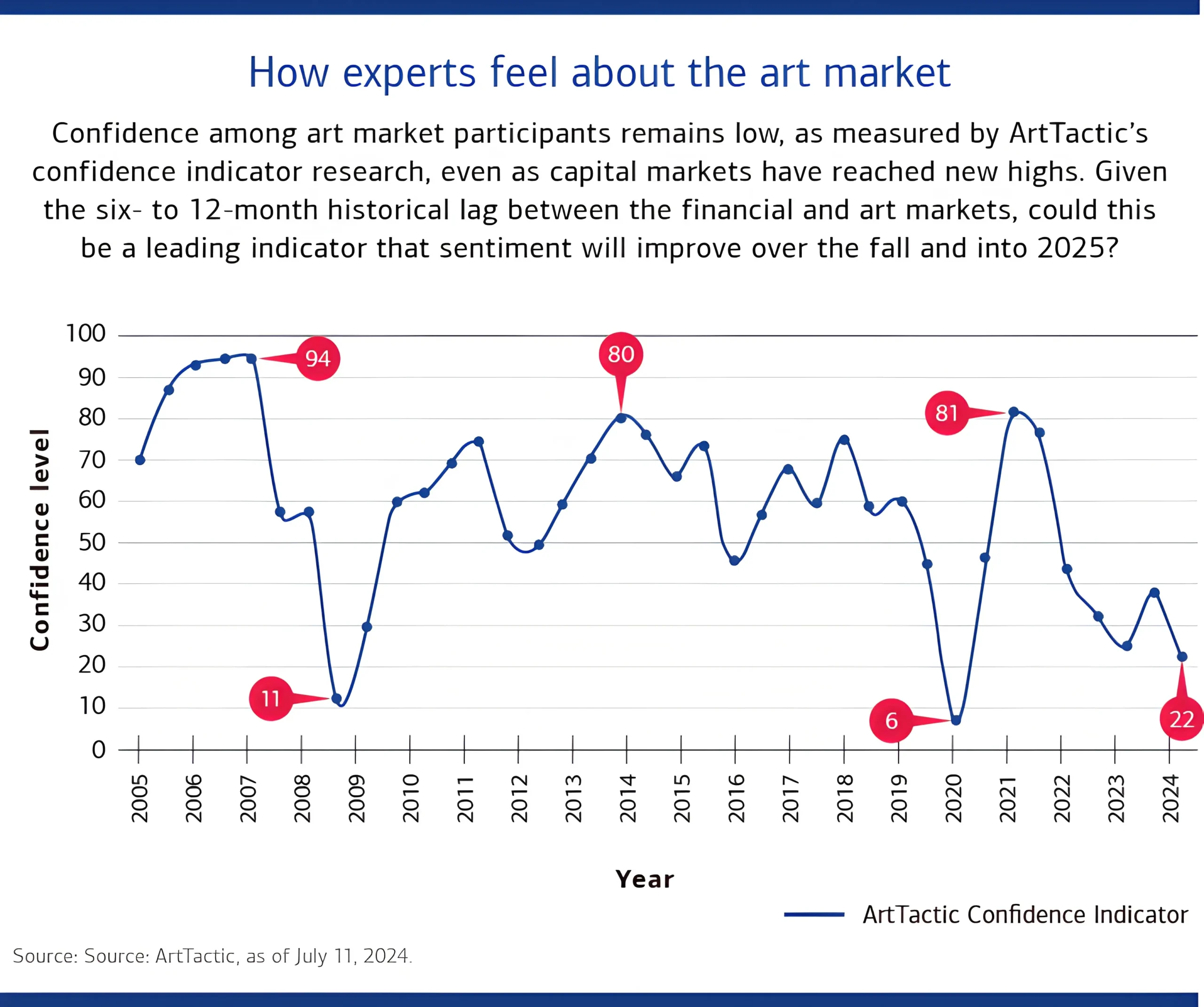

Persistent inflation has eroded consumer purchasing power, prompting individuals to prioritize essential purchases over luxury items. The uncertainty surrounding the global economy– exacerbated by geopolitical tensions– has led to more cautious consumer sentiment. A study found that only about 36% of collectors plan to increase their spending on art in 2024, down from 55% in 2023. This decline in confidence indicates a significant shift in how collectors view their investments amid rising costs and economic instability.

Market Dynamics

Overvaluation and Price Corrections

The art market has seen significant price corrections following years of rapid appreciation. Many artworks that once commanded exorbitant prices are now being reassessed as collectors become more discerning. The All Art index reported an average decline of 16% for art investments by November 2024. This adjustment reflects a broader trend where previously inflated valuations are now being recalibrated. For example, the average price per lot sold at auctions fell to its lowest level in a decade, with some high-profile auctions failing to meet their reserve prices. This recalibration is indicative of a market that is becoming more rational after years of speculative buying.

Declining Auction Participation

Major auction houses have reported double-digit declines in sales as collectors adopt a more cautious stance. A Deloitte report highlighted that international auctions are experiencing a slowdown after two years of exuberance, with many collectors now carefully assessing each purchase rather than making impulsive decisions. In 2024, the global art market saw overall sales dip by 4% to $65 billion, while auction sales specifically fell by 27%. Notably, Sotheby’s reported that their total sales dropped by nearly 30% compared to the previous year, underscoring the challenges facing high-end auction houses. The decline in participation may also reflect a growing wariness among collectors regarding future price stability and potential resale values.

Shifting Consumer Preferences

Changing Interests Among Collectors

There is a noticeable shift in collector demographics and interests. Younger collectors, particularly those under 40, are increasingly drawn to millennial artists and luxury products outside traditional categories like fine wine and classic art pieces. This generational change signifies a move from established artists toward emerging talent and contemporary design, which may not command the same high prices as their predecessors. Reports note that nearly 60% of younger collectors prefer investing in contemporary art over traditional works.

Exhaustion from Previous Boom Years

The art market boomed following the COVID-19 pandemic, with record-breaking sales figures reported in 2021 and 2022. However, this surge has led to what some analysts describe as “market fatigue,” where collectors feel overwhelmed by rapid changes and inflated prices. As art critic Blake Gopnik notes, many previously hot young artists struggle to maintain value as buyers expressed feeling overwhelmed by the sheer volume of new artists entering the market. This saturation may lead to increased difficulty for individual artists in gaining recognition and value amidst an ever-expanding pool of talent.

The Impact of Elections on the Art Market

Historically, election years have shown trends in which auction totals contract sharply. For instance, past presidential elections have coincided with declines in high-value auctions due to uncertainty surrounding fiscal policies and consumer sentiment. Auction totals in the first half of 2024 were reported to be at their lowest since the pandemic shock in 2020.

As industry experts note, uncertainty regarding election outcomes can lead to hesitancy among buyers. They may delay transactions until they know new policies that could affect their financial situation. For example, an indeterminate or disputed result after the election may further distract potential buyers from participating actively in auctions or making purchases.

The Impact of China’s Market

China’s role as a major player in the global wine market has recently faced challenges. After years of growth driven by rising consumer wealth and an increasing taste for sophistication associated with wine consumption, per capita consumption peaked around 2012 and has since plateaued. The COVID-19 pandemic exacerbated these challenges due to restrictions on social gatherings that impacted wine sales. In recent years, there has been a notable shift from wine to spirits like baijiu, which remains dominant in China’s alcoholic beverages market.

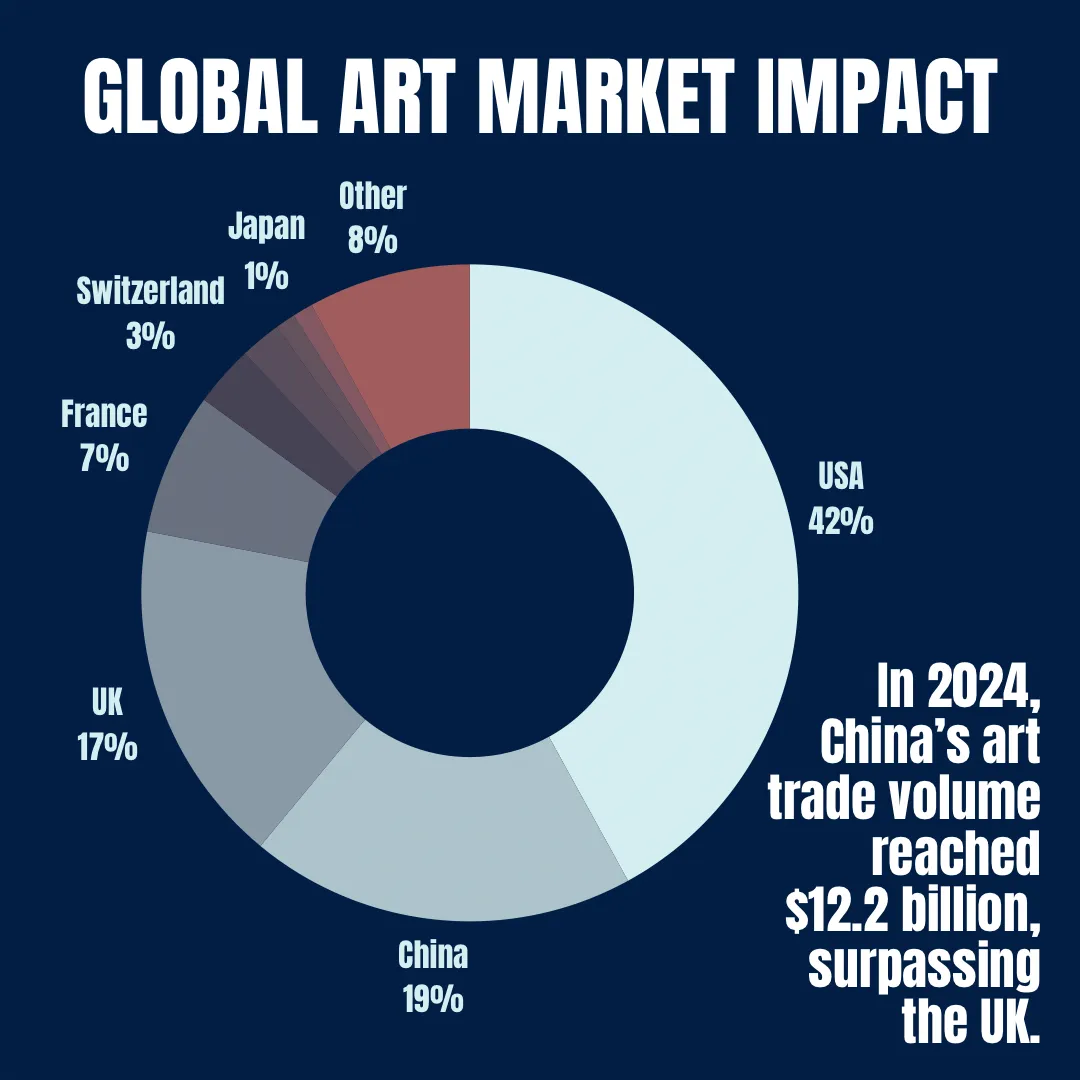

Despite challenges with its wine sector, China’s art market has shown remarkable growth amid global downturns. In 2024, China’s art trade volume reached approximately $12.2 billion – an increase of 9%– surpassing the UK to become the second-largest art market globally. This surge stems from growing local interest in art spurred by new cultural venues and events like Art Basel Hong Kong that elevate China’s status in the global art scene. However, while there is increased spending within China’s art sector, regional dynamics are also shifting; local art fairs are becoming more prominent than traditional auctions. Emerging first-tier cities like Chengdu and Hangzhou embrace this trend alongside established markets like Beijing and Shanghai. The rise of online auctions also reflects changing consumer behavior; major Chinese auction houses have successfully integrated digital platforms into their sales strategies.

2024 Art Market Gains and Losses

The high-end market was the sector most affected by the challenged art market, where transactions over $50,000 dropped by 12%. Conversely, the prints and multiple sectors thrived, experiencing an impressive 18% increase in sales, driven by a growing demand for affordable artworks. Despite the drop in auction houses’ sales, online sales showed resilience, reaching an estimated 18% of the market’s total turnover. Additionally, the number of transactions surged to an all-time high of 132,000, primarily fueled by digitalization and a focus on accessible price points. Collectors strongly preferred artworks priced under $5,000, which constituted 82% of contemporary art sales.

In 2024, the most expensive artwork sold was Renè Magritte’s L’empire des lumières, which fetched an impressive $121.16 million at Christie’s New York in November. This sale not only set a record for the most expensive surrealist artwork ever sold at an auction but also marked the only nine-figure sale of the year. The painting, measuring approximately 150 x 120 cm, is celebrated for its dramatic contrast between day and night, making it a standout piece in Magritte’s renowned Empire of Light series.

Art Market Resurgence: Predictions for 2025

Looking ahead to 2025, the art and luxury goods markets are expected to stabilize and potentially rebound, with sales projected to reach around $70 billion. This optimism stems from anticipated declines in interest rates and easing inflation, which could restore consumer confidence and purchasing power. Additionally, the shift towards digital platforms is likely to enhance accessibility for younger collectors, who are increasingly drawn to contemporary art and emerging talent.

Long-term prospects hinge on several factors: a stable economic environment will encourage investment in luxury assets, changing consumer preferences will drive new trends, and technological integration will democratize access to the art market. While 2024 has posed challenges, the outlook for 2025 suggests a path toward recovery and growth for both sectors.

I truly love indulging in art and it sad to see its decline 🙁

A fascinating analysis of the shifting dynamics in the art and luxury goods market. The 2024 downturn highlights the impact of economic uncertainty, changing consumer behavior, and evolving investment trends. It will be interesting to see how the industry adapts to these challenges in the coming years.

It’s a thorough recap on the art market of 2024.

A fascinating analysis of the shifting dynamics in the art and luxury goods market.