By: Farid Atighechi

Early in 2025, Donald Trump began his second term as president. Many held their breath anticipating significant global changes—especially affecting our region—given his past policies’ impact on international relations.

Countries such as Iran, Afghanistan under Taliban rule (to some extent), Iraq—and notably—Palestinian cause face uncertain futures under his administration. Meanwhile, others like Egypt and Jordan remain concerned about potential shifts due partly because they’ve been mentioned as destinations in proposals involving large-scale relocation plans affecting over two million Palestinians—a notion met with skepticism by both nations’ governments.

Additionally, GCC states worry about U.S.–imposed pressures given by President Trump’s transactional diplomatic approach, which often emphasizes economic leverage over traditional alliances.

This article reviews initial policy announcements concerning Middle Eastern affairs within broader regional dynamics, focusing on key economic factors at play across several significant nations, including five major oil exporters (United Arab Emirates, Saudi Arabia, Iran, Oman, and Qatar) alongside two middle-income economies (Egypt and Jordan).

Egypt and Iran have significantly larger populations than other countries in their group. While this demographic advantage contributes to military strength, it does not necessarily translate into substantial economic influence. Indeed, both nations trail behind their peers economically; notably, Iranian performance lags across nearly all regional metrics.

Some countries, including UAE, Saudi Arabia, Oman, and Qatar, excel at optimizing wealth, leading them ahead regarding output efficiency and this enhances overall national standing within global trade networks. Conversely, states such as Egypt and Jordan struggle to utilize available talent pools effectively, hindering growth prospects. Iran faces severe challenges stemming from extensive brain drain, causing the mass migration of professional skilled workers and unskilled workers, largely due to internal factors rather than purely external pressures.

Institutional integrity alongside financial planning, contractual agreements, and international relations, play crucial roles. Economic activity thrives when these elements align. MENA regions historically lack strong meritocratic systems and free markets, making them more lawless. Nonetheless, some nations, notably UAE, Saudi Arabia, and Qatar have made strides in stabilizing policy frameworks, bureaucratic processes, and foreign affairs. Furthermore, these Gulf states fostered robust partnerships between government and private sectors, enabling efficient governance, enhanced public services sustainability, and fostering trust, ultimately positioning them favorably within global supply networks. Conversely, Egypt & Iran face corruption exacerbated by incompetence and geopolitical tensions, which pose significant operational risks to business operations.

KSA, UAE, and Qatar boast higher market capitalization levels for their companies which enhances the attractiveness and safety of both domestic and foreign investments, ultimately enabling local firms to secure the funding necessary for development growth. In contrast, Iran’s Tehran Stock Exchange features an average price-to-earnings ratio of around 6, highlighting limited investment depth, whereas in advanced economies, this metric typically exceeds 30.

Saudi Arabia, Oman, and Qatar have high rents in that order. All oil-exporting countries in our group heavily rely on rent income, unlike the UAE. However, the difference lies in how this rent is reinvested into assets—whether tangible or otherwise. For instance, Saudi Arabia, Oman, and Qatar have sovereign wealth funds valued at over $900 billion, $50 billion, and $520 billion, respectively. These funds are diversified globally across high-quality investments. In contrast, the UAE manages a combined sovereign wealth of approximately $1.4 trillion and leads the MENA region in R&D spending by a significant margin. Egypt closely follows the UAE in R&D expenditure per GDP while Saudi Arabia and Oman have among the lowest.

Jordan and Egypt exhibit the highest energy productivity within our group, while Iran has the lowest. This disparity is partly due to Iran’s underdeveloped service-oriented sector. Additionally, Iran’s resource extraction and utilization practices rely on outdated technology, leading to inefficiency and high production costs despite low labor and energy expenses. Notably, Iran ranks second in natural resource extraction—primarily petroleum and gas—after Saudi Arabia, but has the lowest material productivity. Material productivity measures the economic output or value added per unit of materials consumed.

Donald Trump has become a figurehead for extreme right-wing politics, inspiring leaders from South America to South Korea. For instance, the President of South Korea has been accused of emulating Trump in actions reminiscent of an insurrection. Despite numerous controversies surrounding Trump, his inauguration coincided with significant upheavals in the Middle East. One notable example is Israel’s actions in Gaza, which have been described as “genocide” by Amnesty International and similarly condemned by the International Court of Justice. Additionally, following the collapse of Assad’s regime in Syria—previously backed by Iran and Russia—the new head of state, Ahmed al-Sharaa, made Riyadh his first foreign visit destination.

On February 2, Syria’s new leader, Ahmed al-Sharaa, visited Saudi Arabia to meet with Crown Prince Mohammed bin Salman. This diplomatic engagement marked a significant shift in Syria’s alliances away from Iran and toward the Gulf states. Meanwhile, in the United States, President Trump has made controversial statements regarding international territories. He suggested that the U.S. would “take over” the Gaza Strip and develop it, stating that people should not return there due to its unsuitability for habitation. This declaration aligns with other ambitious claims by Trump to acquire strategic locations such as the Panama Canal, Greenland, and even Canada.

Contrary to expectations, Trump has managed to secure a ceasefire in Gaza, although former President Biden claims credit for laying the groundwork. A high-ranking Hamas official described Trump as “serious” in these negotiations. During his first term and after his re-election in 2024, both Trump and his advisors emphasized that they do not seek regime change in Iran. This stance remains unexplained by his administration but is speculated to be due to Iran’s robust internal security apparatus. Trump views Iran as being too close to developing a nuclear bomb and has reinstated his “maximum pressure” campaign aimed at achieving zero oil exports from Iran. Instead, he prefers a Verified Nuclear Peace Agreement that would allow Iran to grow peacefully while prospering economically. However, given that Iran heavily relies on oil rents for its GDP—essentially measured by crude oil sales—it faces significant challenges supporting its population due to declining revenue.

Despite Iran’s dissatisfaction, Egyptian President Abdel Fattah el-Sisi expressed optimism during a phone call with Trump that the new U.S. administration could usher in a “golden age of Middle East peace.” Jordan and Egypt remain closely aligned with the U.S. despite some differences in handling the Gaza situation. Notably, Egypt’s security, along with Israel’s, is exempt from Trump’s general pause on foreign aid. However, the U.S. expects both countries to accommodate Palestinian and Gazan refugees potentially on a permanent basis. Trump’s second administration has adopted an aggressive agenda focusing on security issues, including energy security. He has criticized North Sea energy policies and accused London of undermining oil and gas revenues while advocating for an end to windmills.

Additionally, he plans to revoke Biden’s ban on offshore drilling and has threatened the European Union with tariffs unless it increases purchases of U.S.-produced oil and gas. Iran faces significant challenges under these policies; its condensate production was approximately 900 thousand barrels per day last year. By November, China’s imports of Iranian crude oil had dropped sharply to 1.31 million barrels per day—a significant decline from October levels (524 million barrels) due in part to ongoing sanctions.

China has shifted its oil sourcing, increasingly purchasing from the UAE and other regions. Iran faces challenges due to infrastructure issues and sanctions. In November, a German company was penalized for evading sanctions by smuggling a decommissioned petrochemical plant into Iran. During the final days of Biden’s presidency, Iran’s oil exports sharply declined due to stringent sanctions imposed by his administration.

President Trump has pledged to revive his “maximum pressure” policy towards Iran, which will likely impact Iran’s oil production and sales. This move aligns with broader efforts by OPEC+ countries, such as the UAE, Saudi Arabia, and Qatar, to adjust their energy strategies by emphasizing gas condensate production—exemplified by Aramco’s Jafurah project. Energy security is a key component of Trump’s strategy against China. However, in the MENA region, the Palestinian issue remains more prominent. Trump has reiterated support for Israel having significant influence in regional affairs. Israeli Prime Minister Netanyahu stated in December that they aim to reshape the Middle East and are working towards completing this objective through discussions with President-elect Trump. The future trajectory of Netanyahu’s leadership is uncertain due to ongoing judicial cases against him; however, it is unlikely that Israel will deviate significantly from its current path aimed at dismantling Iranian proxies and allies.

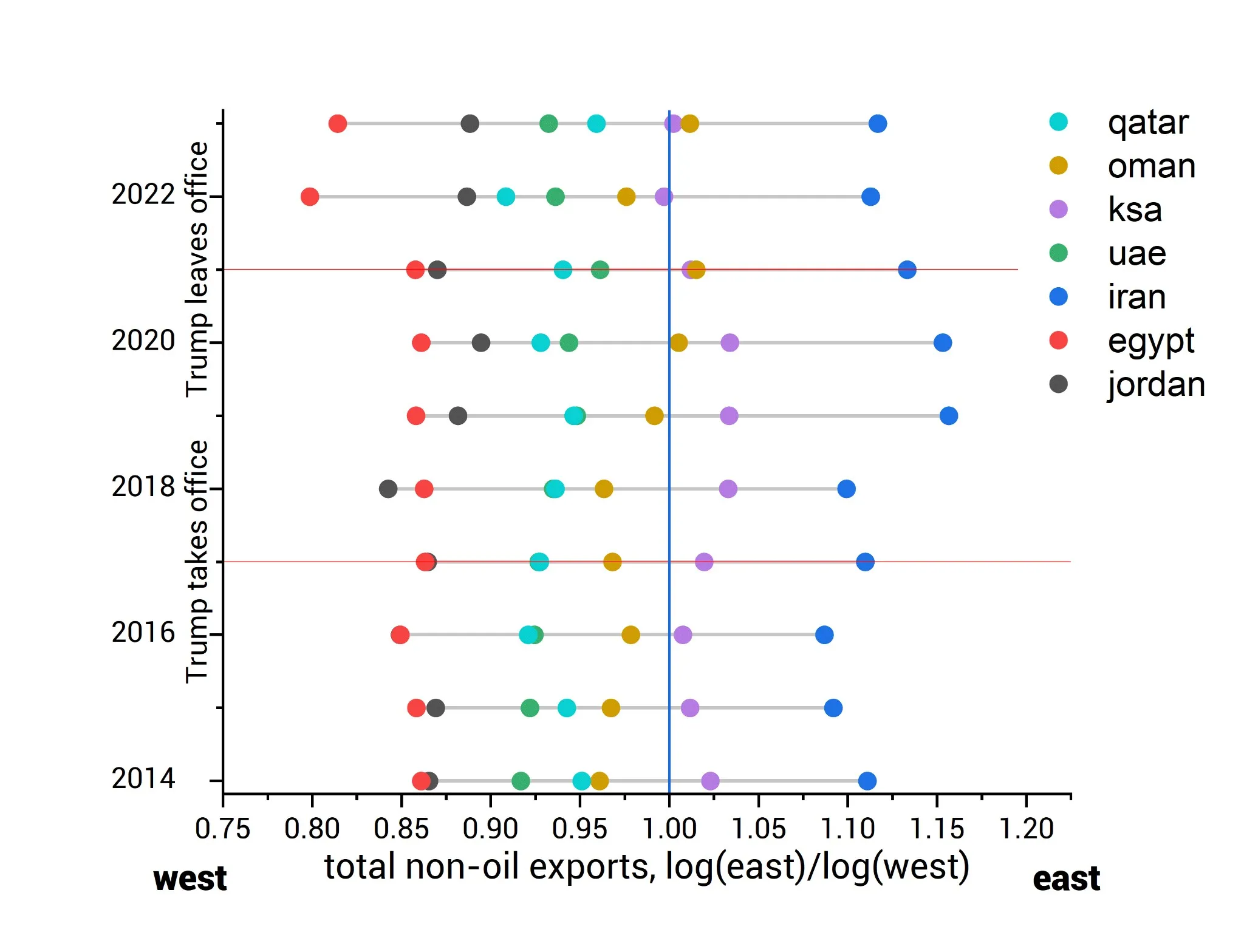

As developing countries, our analytical group of nations holds a lower position within global value chains. Their place in the global economy is contingent on their alignment with dominant powers. Historically, this was straightforward due to U.S. hegemony. The U.S. industry has long relied on offshoring low-value jobs to third countries to remain competitive on costs, allowing these countries to capture a small share of export value and benefit from the transfer of non-critical technologies that support their domestic industries. However, this dynamic is changing as China emerges as a rising economic power, challenging U.S. dominance alongside Russia and other members of the Eurasian Economic Union by expanding its influence westward. The Trump administration seeks to curb China’s rise through aggressive policies from Panama to the Arctic and appears more inclined towards reshoring than its predecessors. This shift could leave regions like MENA in a precarious position.

Countries producing low-value components are increasingly confident in seeking new markets and establishing their own global supply chains. For instance, GCC investments in media and entertainment have extended as far as the UK. However, building such networks is challenging. Emerging markets in Eastern regions and BRICS countries may offer more affordable entry points with higher growth potential. There are significant differences between Chinese and American foreign policy approaches. The U.S. operates under the principle of American exceptionalism, often adopting an interventionist stance through economic sanctions to influence behaviors and policies abroad. In contrast, China adheres to a non-interference policy, preferring incentives to build relationships rather than imposing its will on other nations’ internal affairs. Additionally, China tends to focus its strategic partnerships closer to home.