By: Asal Taheri

Every year, billions of dollars are spent globally on artworks, with some pieces exchanging hands for tens of millions. But what justifies these astronomical prices? The valuation of art is complex, influenced by factors such as demand, the artist’s reputation, and the quality of the work. Unlike commodities, art’s value is deeply intertwined with the artist’s vision and emotional resonance, making it challenging to quantify. As audiences seek to satisfy their desire for beauty and artistic expression, they are willing to pay substantial sums. However, the question remains: Can the feelings of an artist be priced, and what criteria should be used to assess the quality of a piece of art?

Beyond Necessity: Why Art Triggers Us

Many people become angry or surprised when they hear that a work of art has sold for a very high price because they believe art serves no essential purpose. In their view, art neither provides tangible benefits nor connects to vital activities. You cannot live in art, drive it, eat it, drink it, or wear it. Even Plato doubted the value of art, considering it an imitation of reality. For example, if you gave most people $25 million and asked them to choose between buying a six-bedroom house or a painting of two ambiguous red triangles by Mark Rothko, the majority would undoubtedly choose the house. The value of art stems from the interplay of supply and demand in the market. Researchers have distinguished “creative” consumption from “defensive” consumption, highlighting art’s unique role.

The Banana on the Wall: A Case of Absurd Valuation

Take Maurizio Cattelan’s Comedian—a banana duct-taped to a wall—as a striking example. First sold for $120,000 at Art Basel Miami Beach in 2019, it sparked outrage and mockery, with many calling it nonsense: a grocery store fruit turned into art through sheer audacity. Yet, in November 2024, one of its three editions fetched $6.24 million at Sotheby’s New York, shattering its $1–1.5 million estimate. Why this price? It’s tied to Cattelan’s reputation as a conceptual provocateur, the work’s scarcity (only three editions exist), and its viral status—amplified by social media and stunts like performance artist David Datuna eating it. People think it is unusual because it defies traditional art norms, yet its value lies in the cultural conversation it ignites, not the banana itself. The buyer, crypto entrepreneur Justin Sun, even plans to eat it, further blurring the lines between art and absurdity.

Why Art Doesn’t Play by the Rules

Modern art movements like pop art and conceptual art often fetch astronomical prices despite their apparent simplicity, outpacing traditional masterpieces that demand far more material, time, and energy. Take Andy Warhol’s Campbell’s Soup Cans (1962), which sold for $11.8 million at Christie’s in 2015, or Jeff Koons’ Balloon Dog (Orange), which fetched $58.4 million at Christie’s in 2013. These works, rooted in everyday imagery and ideas—soup cans or a metallic balloon animal—resonate with contemporary audiences through their bold commentary on consumerism, mass culture, and irony. Their value skyrockets due to the artists’ iconic status, the cultural relevance of their messages, and the limited supply of authenticated pieces, which fuels demand among wealthy collectors. In contrast, a 19th-century masterpiece, like an intricately detailed English seascape that took months to paint, might sell for under $100,000 today because it lacks the modern appeal, market buzz, and social media virality that drive today’s art market, often appealing only to a niche group of historical art enthusiasts.

A Shrewd Investment or a Passionate Gamble?

Empirical studies show that the fine art market is more volatile than financial markets and offers lower long-term returns. Cultural economists define the difference in these returns as “psychic income.” Moreover, many cultural economists believe that consuming experiential and creative goods contributes to accumulating human capital, a benefit not associated with defensive goods. This explains why art possesses some characteristics of public goods and why most cities allocate art grants. Many artists mistakenly factor psychological elements—such as the emotion invested in their art or the anxiety and fear experienced while creating it—into the valuation of their work. In such cases, a high price may deter future customer interest.

How Production Costs Impact Value

Like currency, the commercial value of art is based on collective intention. One reason a painting or sculpture may be more expensive or cheaper than another is its size. Larger works generally command greater financial value than smaller ones. Depending on the techniques and tools used, the production costs of artworks vary. In 1895, Auguste Rodin paid the Le Blanc Barbedienne foundry to cast his bronze sculpture, The Burghers of Calais. Today, Richard Serra pays the Peichan Company to construct his large steel ovals. These costs are typically recouped during the initial sale of the artwork through its first buyers. If there are five or ten copies of a sculpture, the market price of each will be lower than that of a unique work.

A Material World of Art Valuation

Beyond construction and molding in sculpture, the costs of materials used in painting and drawing are less significant. Oil paint on canvas is considered a durable medium; without direct damage, such paintings can withstand humidity, extreme temperatures, and sunlight. This is not true for works on paper. Generally, works on paper have less value than canvas paintings, though the secondary market sometimes assigns higher value to paper works by artists like Edgar Degas and Mary Cassatt compared to their oil paintings. A rough rule of thumb in the primary market is that colored works on paper—created with oil paint, gouache, watercolor, or colored pencils—are worth more than monochrome works made with charcoal, pencil, or red chalk.

Second Chance or Second Rate?

Aside from purchasing new works directly from the creator or their seller, all other art transactions—such as works by Old Dutch Masters, 19th-century English seascapes, Impressionist paintings, or Cubist masterpieces—occur in the secondary market. When a piece is sold by its original owner, how is its commercial value determined in this market? Unlike most goods, which lose value after use, art’s commercial value in the secondary market is broadly shaped by supply and demand, though this can be influenced by the artist’s primary dealer.

How Scarcity and Desire Interplay

William Acquavella, an experienced art dealer, has told clients, “You can regain your money, but you won’t be able to recreate the painting.” When a high-quality artwork is sold, it becomes scarce, justifying its high price and underscoring the uniqueness of its ownership. Consider buying a work from a living artist; a collector might say, “They will not create a similar painting again.” Monet, who painted until his death at 68, is considered prolific, with two thousand works. Van Gogh, who died at 37, left behind 864 paintings, while Pollock, who passed away at 44, produced 382 canvases.

Decoding the Elements of Art Value

The primary condition for collecting art and design is an inherent desire and interest in an object, forming the initial connection between the viewer and the artwork. One collector may be drawn to picturesque 19th-century landscapes, while another values late 20th-century color photography. This emotional connection creates personal value, though personal preferences vary widely. Converting a passion for art into monetary value requires considering several factors:

Condition, History, and the Allure of Authenticity

Condition is a critical factor in determining an artwork’s value. Has it been preserved under consistent conditions since its creation? If conditions have changed, how have they affected the artwork’s structure? Other key elements include its sales history, ownership, and recent prices of similar works by the same artist, obtainable through auction records and public sales.

Provenance Adds to the Price Tag

When an artwork enters the secondary market, it acquires a provenance—the history of its ownership. In May 2007, an untitled Rothko painting (Yellow Rose, Pink, and Purple), owned by David and Peggy Rockefeller, sold at Sotheby’s for $72.48 million. The next day, Christie’s auctioned a similar Rothko painting—differing in size, date, and vibrancy, with a less distinguished provenance—for $29.92 million.

Condition Report

A condition report documents the results of a physical examination of an artwork by specialists. Art dealers and auction houses typically provide brief reports, such as, “The overall condition for a painting of this period is good.” In contrast, museum conservators produce detailed analyses.

Quality: The Ultimate Deciding Factor

No factor influences an artwork’s price more than quality. Mastery of the medium, clarity of execution, and authority in expression are vital criteria applicable to any artwork, regardless of style or subject. Artists may not always judge their own work accurately; financial need or self-promotion can lead them to sell subpar pieces. Not every work by a renowned artist is a masterpiece—some are worth little more than the signature.

Comparing Art to Art

Artworks are valued by comparing them to similar items in the market. Sales history is a key variable in comparability; an artist with a larger volume of public sales records carries more weight than one with fewer. For an artist debuting at an auction with only ten public sales, any price achieved is crucial for establishing value.

How the Subject Influences Price

The subject of an artwork reflects the artist’s engagement with a specific genre. Pablo Picasso exemplifies this: his Cubist works from 1908 to 1914, exploring simple geometric forms, differ in style, date, and subject from his portraits of the 1940s and 1950s, resulting in significant price variations.

Rarity: A Guarantee of High Price

Rarity depends on an artist’s market presence or the number of works from a specific period that still exist. Combined with demand, rarity significantly drives price. Picasso’s late 20th-century figurative paintings are scarcer than his 1920s works, while his early Blue Period pieces—marked by extensive use of blue and dark tones—are highly rare and sought after by museums and collectors, fetching exorbitant prices due to this scarcity and demand.

Art Valuation in the MENA Region

In the MENA region, art valuation largely mirrors global methods, relying on artist reputation, provenance, rarity, and market demand, yet it is infused with unique cultural and economic nuances. Auction houses like Christie’s and Sotheby’s, prominent in cities like Dubai, apply techniques such as hedonic pricing—where attributes like size, medium, and historical sales data determine value—to works by international artists like Picasso or Rothko. For instance, a Picasso Cubist piece sold at Christie’s Dubai might fetch millions, driven by its rarity and global demand, aligned with Western auction trends.

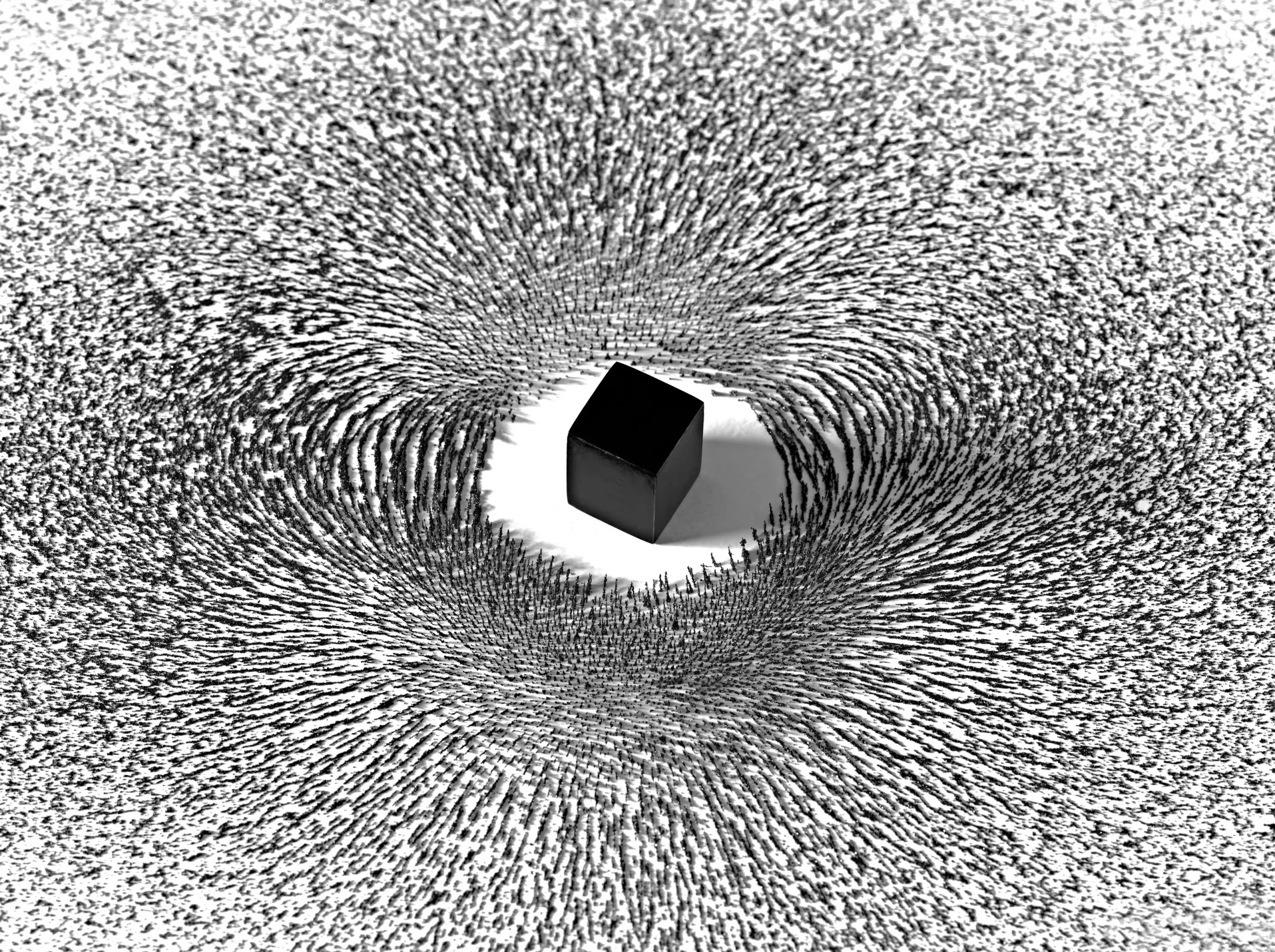

However, the MENA art market diverges when valuing regional artists, where cultural significance and local collector preferences play a larger role. Consider Iraqi artist Jewad Selim’s Baghdad Family (1957), which sold for $1.2 million at Christie’s Dubai in 2022—its depiction of traditional life and modernist style resonates deeply with Arab identity, pushing its price beyond mere scarcity. Similarly, Saudi artist Ahmed Mater’s Magnetism (2012), featuring iron filings forming a Kaaba-like shape, fetched $1.8 million at Sotheby’s Doha in 2023, reflecting regional reverence for Islamic themes. In the UAE, Emirati artist Hassan Sharif’s conceptual Objects series sold for $650,000 at Ayyam Auctions in 2024, its minimalist critique of consumerism amplified by Gulf collectors’ pride in local pioneers. Unlike Rothko’s abstract works, which lean on universal emotional appeal, MENA valuations often prioritize narrative ties to heritage, postcolonial identity, or Islamic art traditions, which may not translate as directly globally. The region’s oil wealth and royal patronage further inflate demand, sometimes skewing prices beyond traditional metrics.

The Future of Art Valuation

Art valuation remains a fascinating blend of emotion and economics, but where is this topic heading? The industry is already embracing innovation, with AI tools like Artprice analyzing auction data and trends, while platforms such as ARTDAI and Artory leverage machine learning to appraise artworks and verify provenance, offering a more precise approach to pricing. However, regulatory efforts to curb exorbitant art prices are absent for now—neither globally nor in MENA are there imminent plans to impose limits. The market’s free-spirited nature prevails, and in MENA, the focus leans toward preserving cultural heritage rather than controlling costs.

Looking forward, the art world is set to evolve with growing wealth in regions like MENA and Asia, alongside technologies like blockchain, enhancing transaction trust. Prices may not climb endlessly—economic shifts could temper enthusiasm—but art’s enduring appeal as both an investment and a passion suggests resilience. Collectors, aided by AI-driven insights, are likely to become more selective, prioritizing quality and significance over fleeting trends. The future promises a sophisticated balance: a market enriched by technology yet still driven by the timeless draw of creativity.