Mr. Alireza kordlou

Agricultural Economist | Agribusiness

Development Consultant | Entrepreneur

How would you describe the current state of agriculture in Iran? Please provide some key facts and statistics on the share of agriculture in GDP, cultivated land area and the proportions of small-scale traditional and large-scale corporate farms.

Value added for agriculture in Iran stands at 6%. Iran has 18 million hectares of agricultural land, consisting of 11 million hectares of farms, half irrigated and half rain fed, 4 million hectares of fallow land and 3 million hectares of orchards. Annually, 70 and 20 million tons of farm and orchard crops are harvested.

Livestock products include 1 million tons of meat, 2.7 million tons of poultry, 1.2 million tons of eggs, 111 thousand tons of honey and 11 million tons of milk, leaving the agriculture sector with a trade deficit of 5 billion dollars. Most farms are small-scale due to land reforms and inheritance laws. There are an estimated 5 million farmers in Iran, representing 18% of the workforce.

The reduced need for human labor can lead to large corporations squeezing out smaller farms. Will this mean that only major corporations will survive?

The answer depends on efficiency. If the final price of a product is higher than the market price, the producer will go out of business. Efficiency is in turn determined by the scale of operation. The economics of scale link profitability to size, meaning that small-scale farms are doomed to failure unless they receive proper support to join and expand their operation size.

How advanced is agriculture in Iran in terms of deploying automation technology, machinery, and methods and techniques?

Application of technology varies in different agriculture areas. While the greenhouse, dairy, poultry and aquaculture industries have embraced technologies, other industries like farming, orchards, meat and sericulture have not adapted as quickly.

We hear a lot about “smart agriculture”. What is smart agriculture and what advantages does it offer?

Despite what the name suggests, smart agriculture doesn’t necessarily bring about a shift. Ever since farming was invented for food cultivation, the engineering of the environment, and domestication of plants and animals have been smart. Once the smart nature of farming was demonstrated, as recognized by the Globally Important Agricultural Systems program led by FAO, we wanted to know whether it would be possible to make the process even smarter using technological tools. Smart agriculture offers smart solutions to facilitate the application of technology to agricultural production.

Are there arrangements in place for the widespread application of smart agriculture in the country?

As a mainly private sector, stakeholders in agriculture have been adapting and adopting technology with agility. The adaptability and investment sizes, however, depend on the turnover and value engineering in specific sub sectors. To illustrate, dairy and poultry farms in Iran are leveraging technology at highly advanced levels.

If you are interested to read more about GUSTAVO FONSECA Export Department MENA-Beef Division , don’t lose this article.

How does Iran compare to similar countries (e.g., Turkey) in adopting innovative technologies and techniques in farming?

The answers can vary depending on the sub sector. We are lagging behind in orchard and farm technology while our greenhouse, livestock, poultry and aquaculture sub sectors are more technologically advanced.

How has the Covid-19 outbreak impacted Iran’s agriculture sector (demand, supply chain and production)?

Covid-19 affected the valuable agriculture sector supply chain. The final stage, that is consumption, was disrupted at the beginning, followed by further disruptions in the distribution stage intensifying the problem. The damage spread to other sectors including hunting as well.

How do you see the future of smart agriculture at domestic and global levels? What are the key trends and shifts?

The transition from agriculture to agribusiness is made possible through an increase in investments and regulation of foreign policies. However, the low return on investment in agriculture coupled with Iran’s foreign policies poses a problem in leveraging technology. An emerging trend in international agriculture is cross-country cultivation.

What are the opportunities and challenges in Iran’s agriculture (state policies, innovative technologies, private sector initiatives and foreign investment)?

The multiplicity of climatic zones and low energy and labor costs are the main opportunities in Iran agriculture, which reduce production costs and give us a competitive advantage.

The major challenges, which are water, capital, knowledge and information, cannot be addressed unless knowledge replaces politics as the main concern for decision makers. One approach to tackling issues would be to use Agri-PPPs | Public Private Partnership in Agribusiness Development comprised of the following four types

- Agri-PPP in Agri-BDS| Business Development Services

- Agri-PPP in Agri-MID| Market Infrastructure Development

- Agri-PPP in Agri-ITT| Innovation and Technology Transfer

- 4.Agri-PPP in Agri-VCD| Value Chain Development

What are your recommendations to individuals or enterprises seeking investment opportunities in Iran’s agriculture sector? What products should they choose for production and what factors should be considered before making investment decisions?

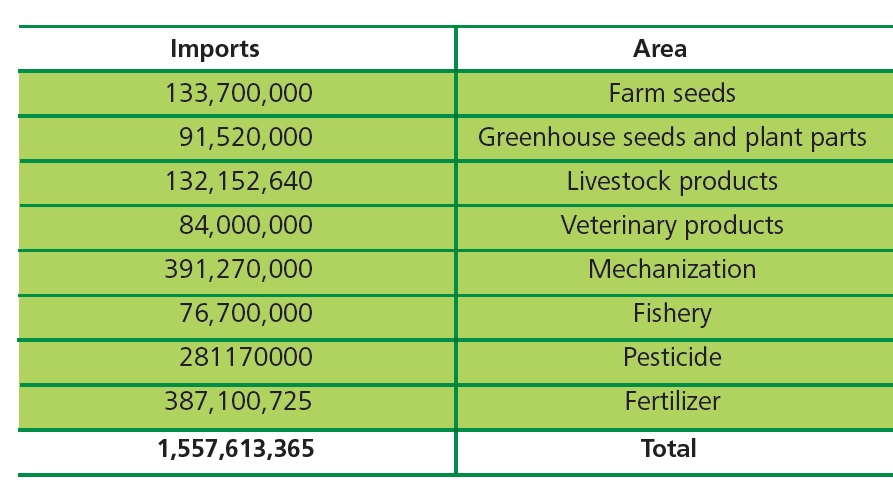

The agriculture sector in Iran is reliant on access to inputs, which face a trade deficit as detailed by the following table.

These are attractive investment areas due to the increasing demand for higher quality inputs. Investments in Makran and Aras regions for exports of agriproducts to Arab and Caucasus markets can also be a productive approach for potential investors. These are attractive investment areas due to the increasing demand for higher quality inputs. Investments in Makran and Aras regions for exports of agri products to Arab and Caucasus markets can also be a productive approach for potential investors.