By: Torquoise Partners

Sentiment on the Tehran Stock Exchange (TSE) was bullish in December, pushing the market index up by 12.2%. Those who invested recently in the belief that share prices were cheap, have seen positive returns for the second month in a row.

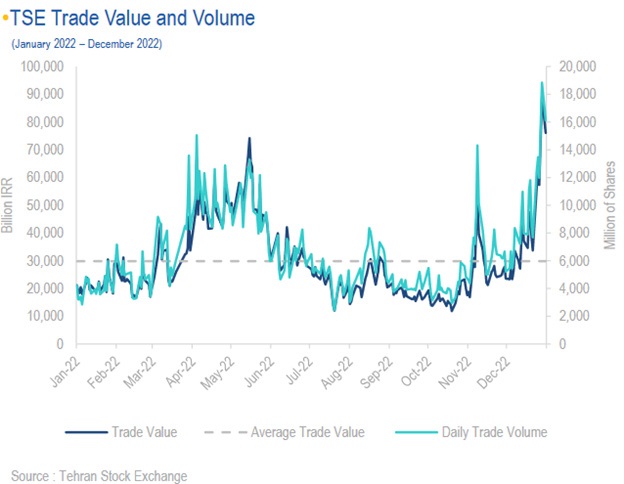

Trade volumes moved significantly higher compared to the one-year average as a result of higher investor activity and a more optimistic market sentiment.

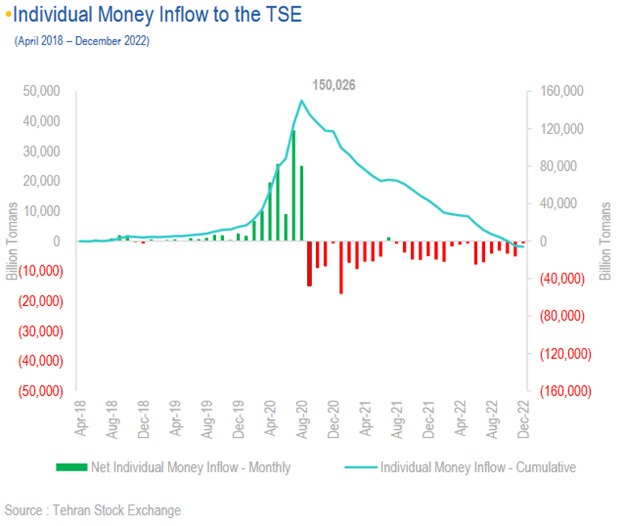

Retail money outflows also were different in comparison to the one-year trend. Retail investors on average were more likely to purchase stocks after having been consistently selling their portfolios for several months.

Retail money outflows also were different in comparison to the one-year trend. Retail investors on average were more likely to purchase stocks after having been consistently selling their portfolios for several months.

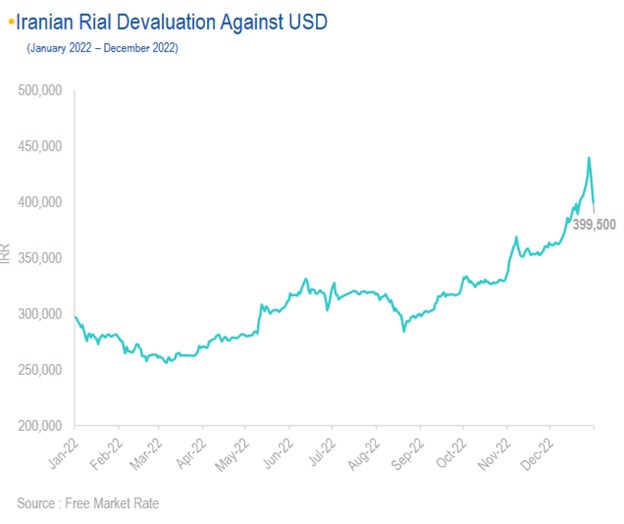

The devaluation of the Iranian Rial continued in December at an even swifter pace. The free market rate of USD/IRR rose by 10% over the course of the month.

Currently, the sentiment is slightly pessimistic regarding a political agreement being reached between Iran and Western countries This is a key factor in creating a spike in demand for international currencies. Contrary to the free market rate, the official rate was only slightly changed; this has resulted in the largest spread ever between the two rates. Although the effective rate for listed companies is mostly correlated with the official Nima rate, stock prices have more or less adjusted to the free market rate.

This might have happened because investors expect this spread to be temporary and for the official rate to rise in the near future. Also, the sharp devaluation in local currency terms have triggered greater demand for other asset classes and the stock market in particular.

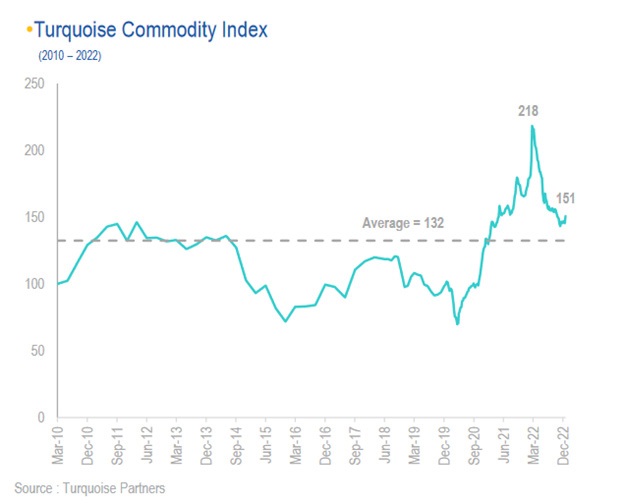

Commodity prices have always significantly influence equity investors in Iran. A major portion of listed companies on the TSE are either commodity exporters or alternatively sell their products in the local market at prices based on global rates. In addition, oil exports are important for the government budget and related expenditures. December was a relatively stable month for commodity prices and consequently, concerns about price falls have subsided at least in the short-term.

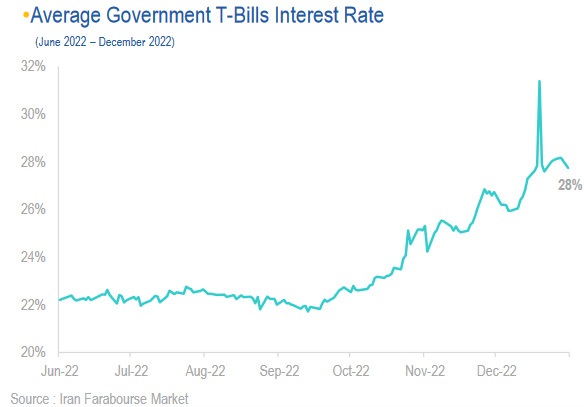

Interest rates continued to increase in December and most fixed-income funds started to offer a higher yield to their investors. Contrary to recent months, however, investors were more focused on buying stocks since the real interest rate has moved lower due to higher inflation expectations The new chairman of the central bank of Iran was appointed at the end of December. There are signs that the sharp increase in the USD/IRR rate and the previous chairman’s insistence on maintaining high interest rates were the main reasons for this replacement.

With the new head of the central bank now appointed, there are greater expectations that there will be more pressure to bring the Rial devaluation under control.

This caused very nervous investor sentiment (due to the correlation between equity strength and a weaker currency). This was manifested after his first official speech when a strong sell off occurred on the last day of December. These concerns were mitigated after the central bank revealed more details about its policies.

For more information on please contact us :assetmanagement@turquoisepartners.com