By: Turquoise Partners

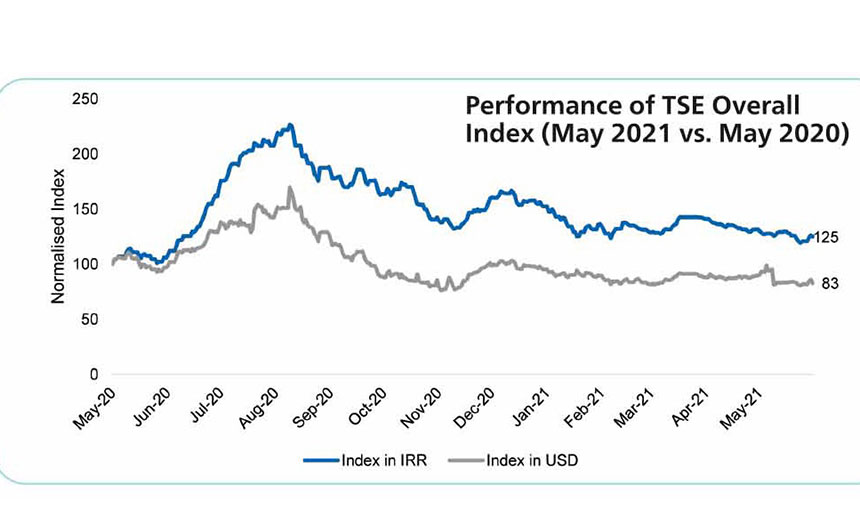

Tehran Stock Exchange continued its corrective pattern in the first six months of 2021, registering a loss of 13% in hard currency terms. TSE overall index declined 7% in April and 5% in May in IRR terms. The IRR exchange rate appreciated from 258,000 IRR per USD in December 2020 to 243,200 IRR per USD ending May 2021. The appreciation of the IRR stems from higher hard currency inflows to the country due to both higher commodity prices and more oil sales (mainly to China). performance of TSE Overall

performance of TSE Overall

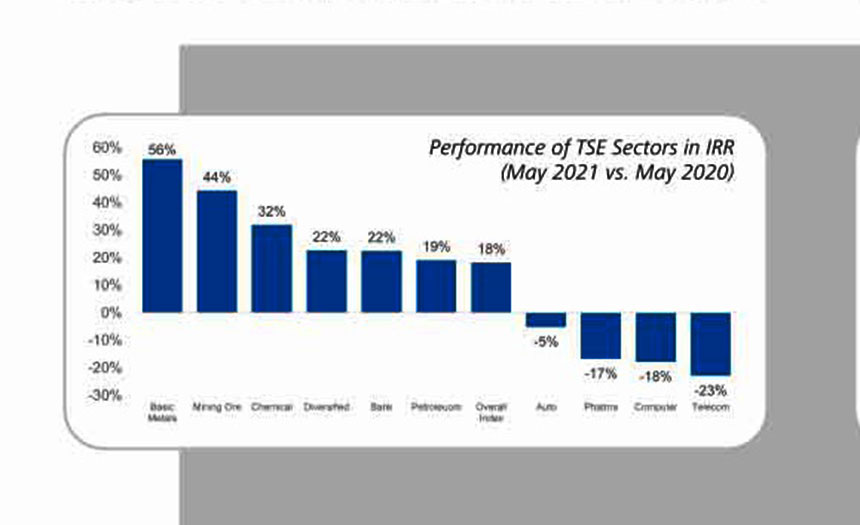

In terms of the best performing sectors on yearly basis, Basic Metals, Mining Ore, Chemical and Diversified Holdings led the way in May. Their related sub-indices surged by 56%, 44%, 32 and 22% respectively in IRR terms. This rise was due to a rebound in global commodity prices, boosted by demand from China. Steel prices in Iran rose by more than 10% over the course of the month, which in turn fueled an increase in steelmakers’ shares on the TSE. For example, Mobarakeh Steel Company – the first and largest listed company by market cap on the TSE – rose 9% in May of this year in market cap. Chadormalu Mining and Industrial Co., the largest producer of iron ore in Iran, was also among the top performers. Its stock price rose by 8% over the same period, reflecting the positive trend in global iron ore prices so far this year.

performance of the TSE sectors in IRR

performance of the TSE sectors in IRR Monthly Inflation Rate

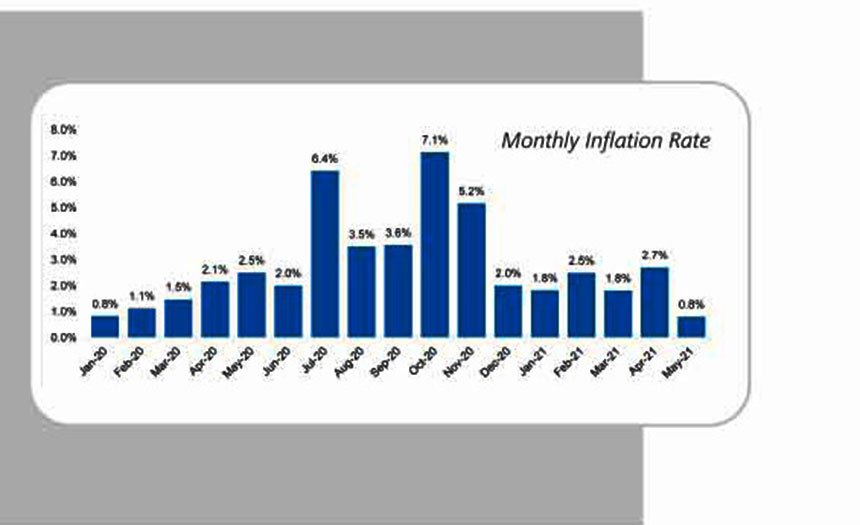

Monthly Inflation Rate

In the domestic credit market, the backdrop has improved as the yields of short-term government debt securities (T-bills) fell below 18%. Declining interest rates for listed debt securities have accelerated recently as inflation has showed signs of cooling down. The latest inflation readings showed that the monthly change of the CPI has fallen to 0.8%, the lowest level since January 2020. Money supply growth also plummeted to 0.6% month-on-month in May 2021. According to the latest data released by the CBI this is the lowest it has been since April 2019.

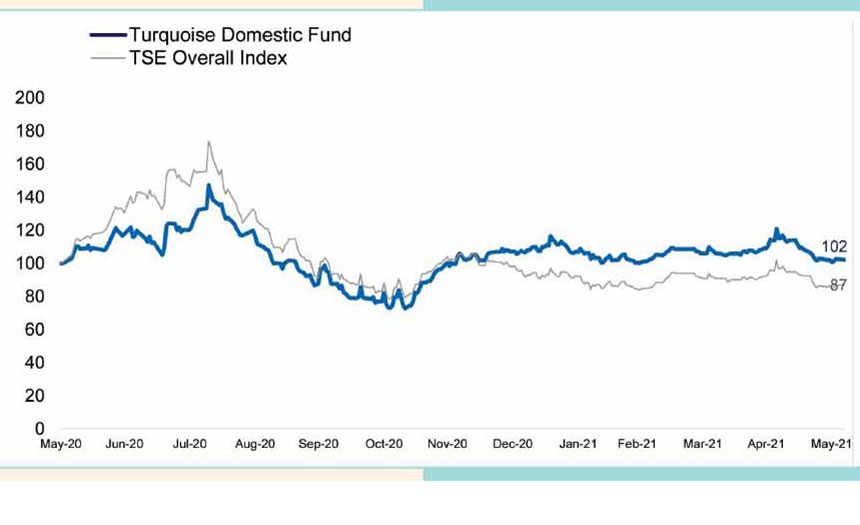

Turquoise Domestic Fund

Turquoise Domestic Fund

With the current prudent monetary policy, we expect the year-on-year inflation to fall below 30% by the year end. This would provide a more stable environment for equity investors in terms of the macro-economic situation.

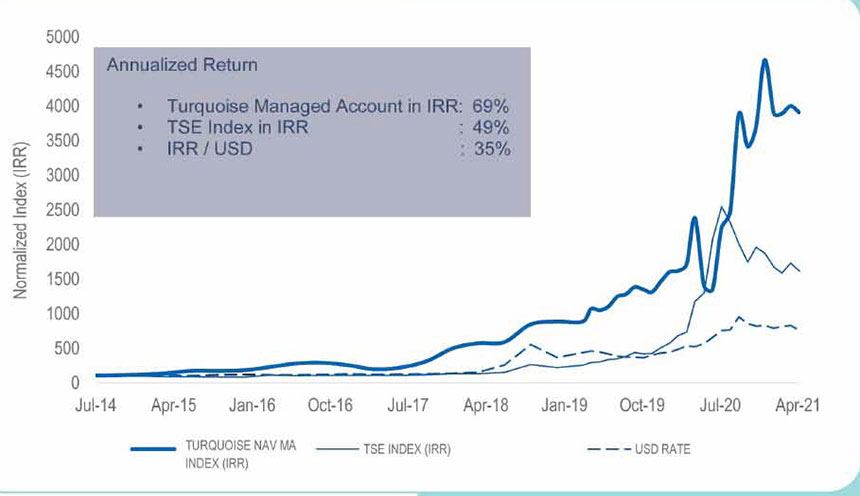

Turquoise Managed Account In IRR

To obtain more information on Turquoise Partners products, please contact us through

our website: assetmanagement@turquoisepartners.com