By: Maryam Rahmani

Maryam Rahmani is a Senior Manager with DAMAC Properties. With her experience of over 15 years in Real Estate industry, Maryam shares her viewpoints and insights into Dubai real  estate market and its highlights.

estate market and its highlights.

With resilience and high adaptability towards the challenges the pandemic has posed to the world, UAE authorities have unceasingly attempted to turn this chaos into an opportunity for the country. It has been an effort to support the welfare of its people and lay down programs and initiatives that would guard not only the people but the economy and ensure the stability of businesses.

In July 2020, Dubai Land Department (DLD) launched a global platform, called “Invest in Dubai”, whic h shed a front row spotlight on Dubai’s Position in real estate on the global front, reinforcing Dubai as a world class destination and promoting quality of life for diverse cultures and nationalities. Dubai Real estate sector witnessed a boom in mid-2020, amidst the global pandemic. Dubai has always been an attractive and sought-after city that has scaled new heights over the three years since the pandemic. With reported sales of billions only in the 1st quarter of 2022, Dubai’s real estate sector had a great start this year. A high tide has been created for the market, embedding the highlights of Dubai’s success and welcoming people from all over the world. The real estate market has a great variety to offer investors in all brackets.

h shed a front row spotlight on Dubai’s Position in real estate on the global front, reinforcing Dubai as a world class destination and promoting quality of life for diverse cultures and nationalities. Dubai Real estate sector witnessed a boom in mid-2020, amidst the global pandemic. Dubai has always been an attractive and sought-after city that has scaled new heights over the three years since the pandemic. With reported sales of billions only in the 1st quarter of 2022, Dubai’s real estate sector had a great start this year. A high tide has been created for the market, embedding the highlights of Dubai’s success and welcoming people from all over the world. The real estate market has a great variety to offer investors in all brackets.

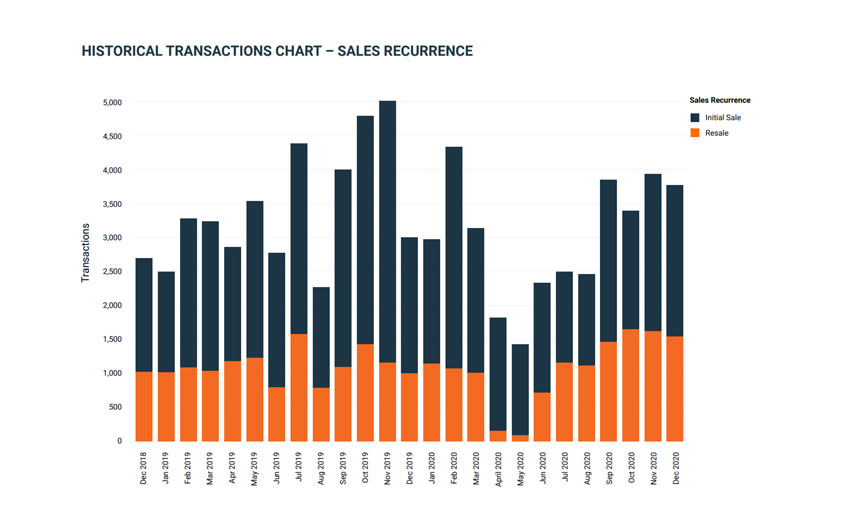

Historical Transactions Chart-Sales Recurrence

Overall, communities like Damac Hills, Dubai Hills and Tilal Al Ghaf are the most popular and relevant areas in Dubai, due to their prices and typology of product. Outside the community range, areas like Downtown Dubai, Business Bay, Creek Harbour and The Palm Jumeirah are in high demand, with all highlighted areas catering to consumers of all brackets. The post pandemic period has seen a huge turnaround in all aspects. Business Bay and Downtown Dubai have high returns with an approximate 8% ROI on the capital invested, whereas short term rentals peaked due to the tourist influx and business increasing for conferences and transactions. There was high demand for townhouses for families, either as end users or future investments. Service charges on townhouses are roughly five times lower than those for apartments. Ownership costs in a onetime payment would be between 6%-8%, including the initial 4% DLD charges.

If you are looking for the Dubai expo 2020, click here please.

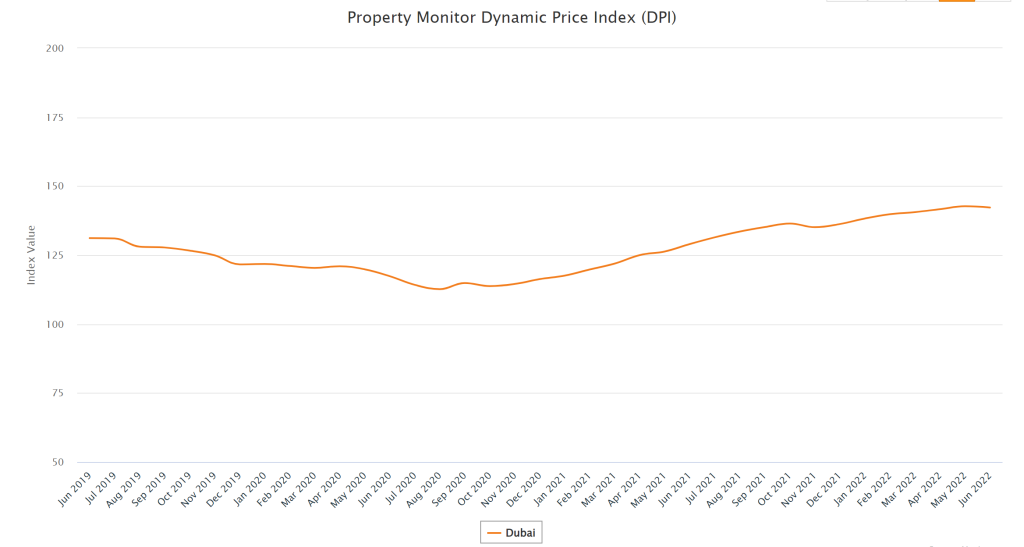

Property Monitor Dynamic Price Index

The yearly costs embedded into property investment would be between 3% to 6% of the property value for villas and townhouses, while costs for apartments would range between 15% to 30%. Several smaller fees such as conveyance fees and agency fees, if applicable, also need to be taken into account. For anyone considering purchasing property, the first option would always be to invest directly through a developer, for better options on payment plans and applicable waivers. This would also mean a brand-new property and no agency fees involved.

The second choice is to approach agencies as product availability would be higher with agencies over time due to secondary market access. The property market will peak in the next 10 months before losing momentum and seeing a correction set in to stabilize the market. However, having earned its position as one of the top10 countries in the world and one of the countries to have survived the pandemic with flying colors, the UAE will continue to attract investors and tourists from around the world, whether or not a correction is to set in. Although the correction would certainly stabilize prices on one level, I believe it would create a gateway for a breed of investors of a different bracket.

One Response